Payroll Solutions for Construction Businesses

Strategic Workforce Management Solutions for

Construction Companies

Our award winning technology makes running payroll and handling taxes simple. As your business scales, so can we!

We understand that construction payroll and HR management are unlike any other industry. Between prevailing wage laws, certified payroll reporting, job costing, and managing a mobile workforce across multiple job sites, the administrative burden on construction companies is significant.

At PeopleWorX, we specialize in helping construction businesses navigate these unique challenges with confidence. Our solutions are designed to simplify compliance, streamline payroll processes, and support your project managers, back-office staff, and field employees with technology that works where they work.

Specialized Construction Business HR Solutions

Certified Payroll

Piece Rate Pay

Custom Data Exports

Enhanced Labor Allocation

Enhanced Timekeeping Tracking

GL Integration

Seamless Integration with Certified Payroll and LCP Tracker

We understand most construction companies run a weekly payroll due to certified payroll requirements and record daily hours, employee deductions, employee taxes, employee classification, projection location, and the prevailing wage. Some contracts may require the construction company to report their Certified Payroll through programs such as LCP Tracker or a proprietary state system like Maryland requires.

Easily Manage Your Weekly Payroll

Help with Mandatory Employee Work Eligibility Audits

We understand that employee verification is an important aspect of construction companies, safeguarding businesses from compliance issues. Sometimes, companies use I-9 and E-verify interchangeably and run into compliance issues. PeopleWorX can guide you and help you with the right process.

In some cases, companies use ITIN and SSN interchangeably. ITIN is an individual TAX Identification Number, and SSN is a Social Security Number which can be considered a verification number.

PeopleWorX can guide you through the employee verification process and keep you out of compliance issues.

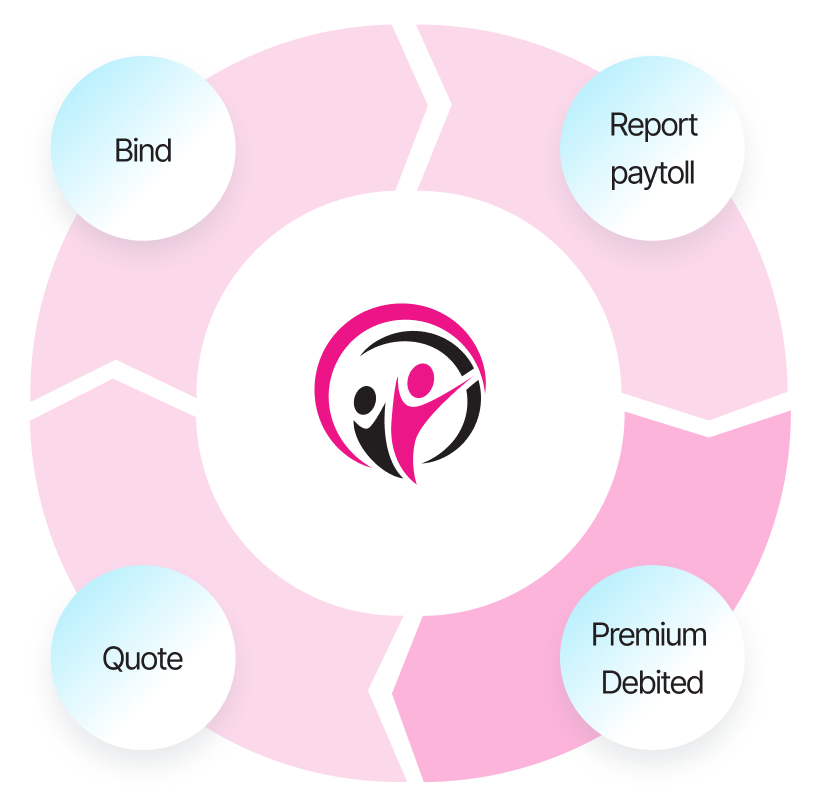

Eliminate surprise audit bills and manage better cashflow with Pay-As-You-Go

As a nature of the industry, construction payroll may experience a spike in labor, which in turn adds up on the workers’ comp. With Pay-As-You-Go, you can eliminate the down payment and pay for the premium only when the payroll is run.

PeopleWorX can help you with Pay-As-You-Go Workers’ Comp and help you manage better cashflow for your business.

Pay as you go

- Improve Cash Flow

- Reduce Audit Exposure

- Monthly Reporting

- Zero Down payment

- Minimize Surprise Bills

- Pay on Your Current Payroll

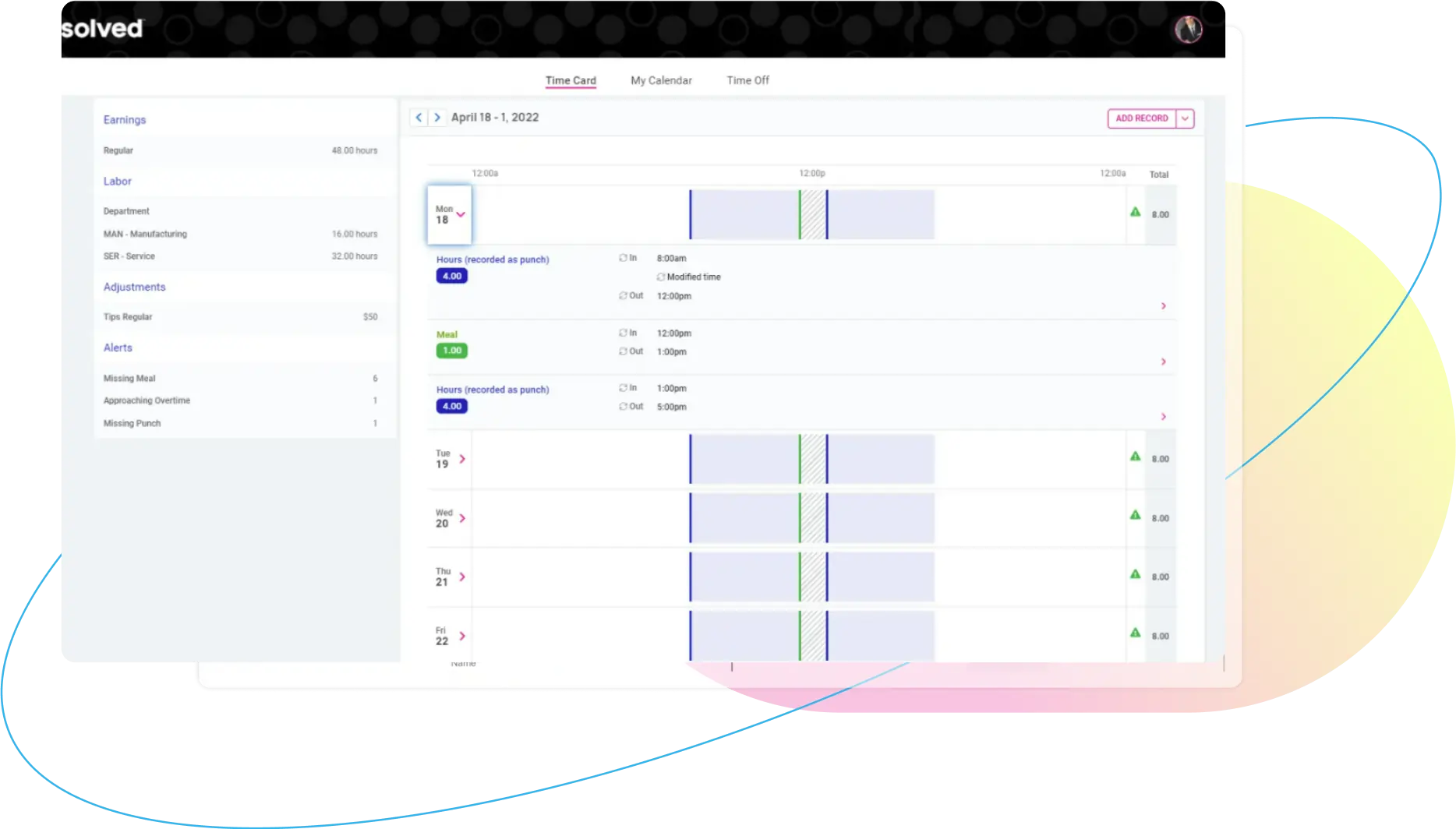

PeopleWorX’s Timekeeping system can help you with tracking employee hours, maintaining schedules, shifts and tracking PTO. We can also assist in job costing for hours.

Easily Integrate Job Costing with Your Accounting System

We understand that many construction companies require Job Costing. If you already have an accounting system in place like Quickbooks, PeopleWorX can easily integrate Job Costing with the accounting system and can help you eliminate errors. If your company use other systems like Jonas, Frontier, Foundation, Great Plains, Timberline etc., PeopleWorX can help you with custom reports that integrate with these programs reducing double entry.

Effective Employee Hanbook creation to help with policies and cut unemployment Costs

We understand that construction businesses, like any business, need to have company policies in place to keep your employees and work environment safe and to safeguard you from legal complications.

With a solid employee handbook in place, construction companies can cut down on unemployment costs. The company should document all employee-related events. When an employee is terminated, the company can present a well-documented case with the necessary reason for terminating the employee.

Like the manufacturing business, construction will also have OSHA requirements. PeopleWorX can help you comply with OSHA procedures, creating or updating employee handbooks and company policies if you require them.

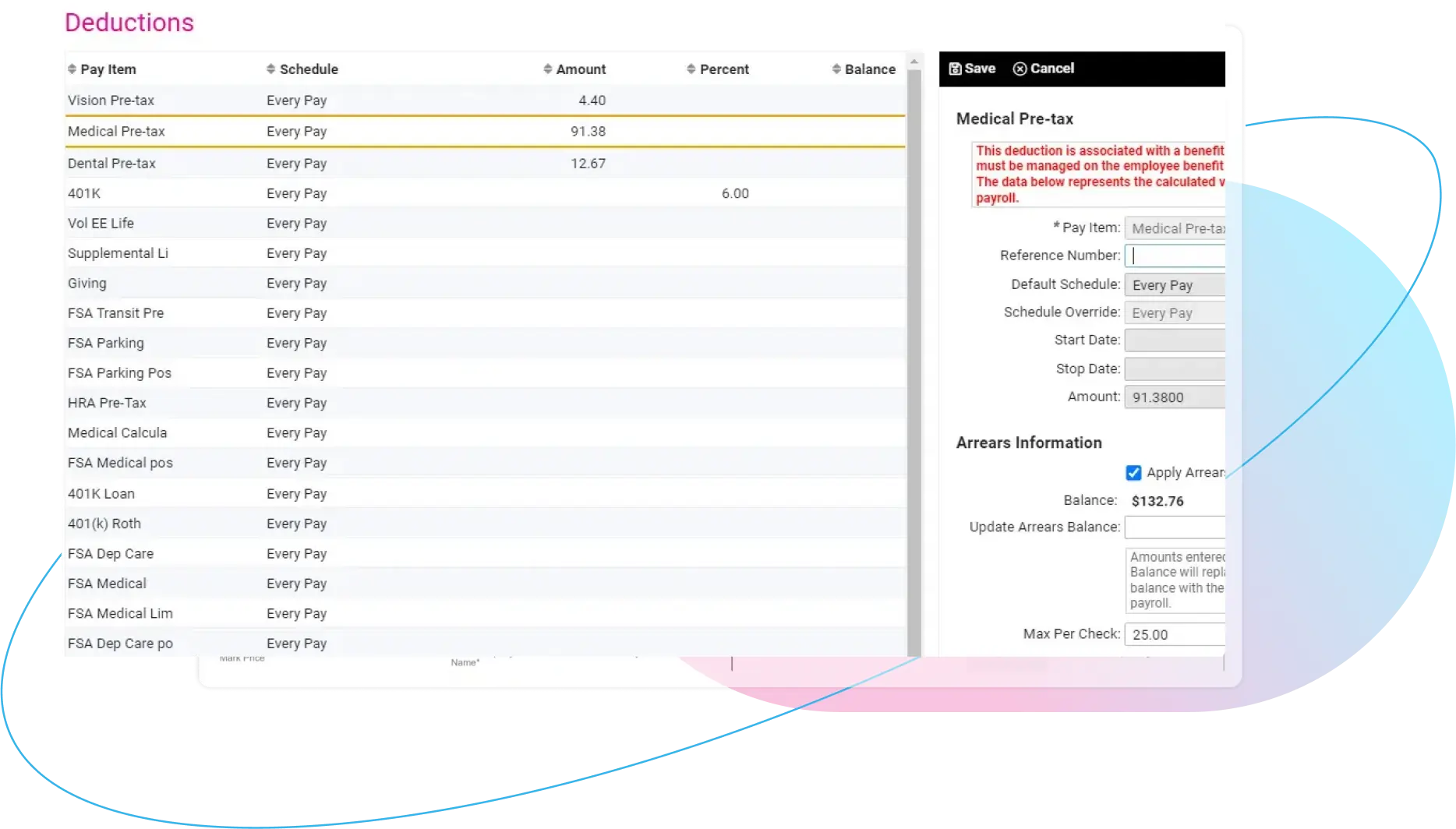

Manage Union Deductions and Union Benefits Easily

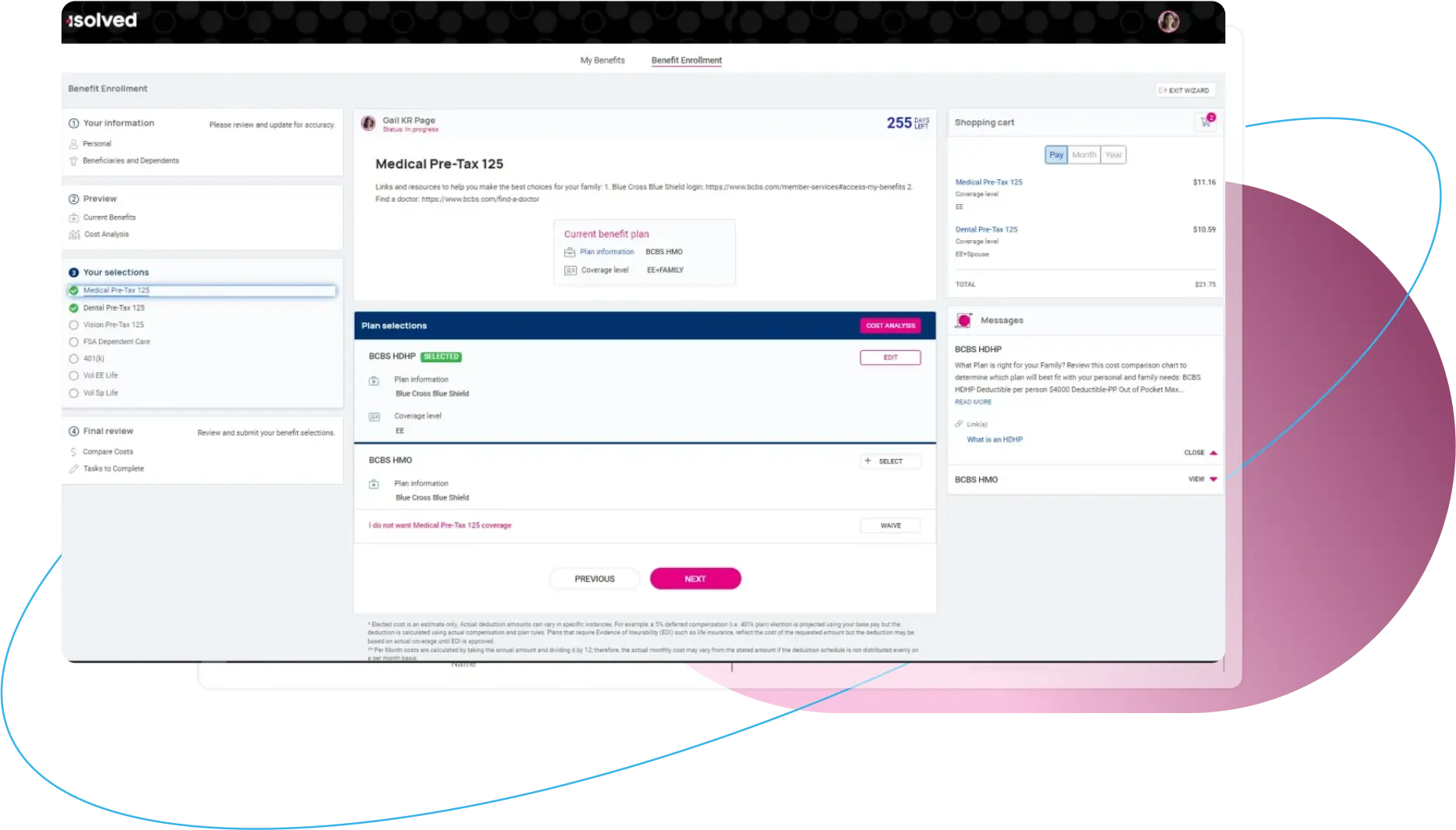

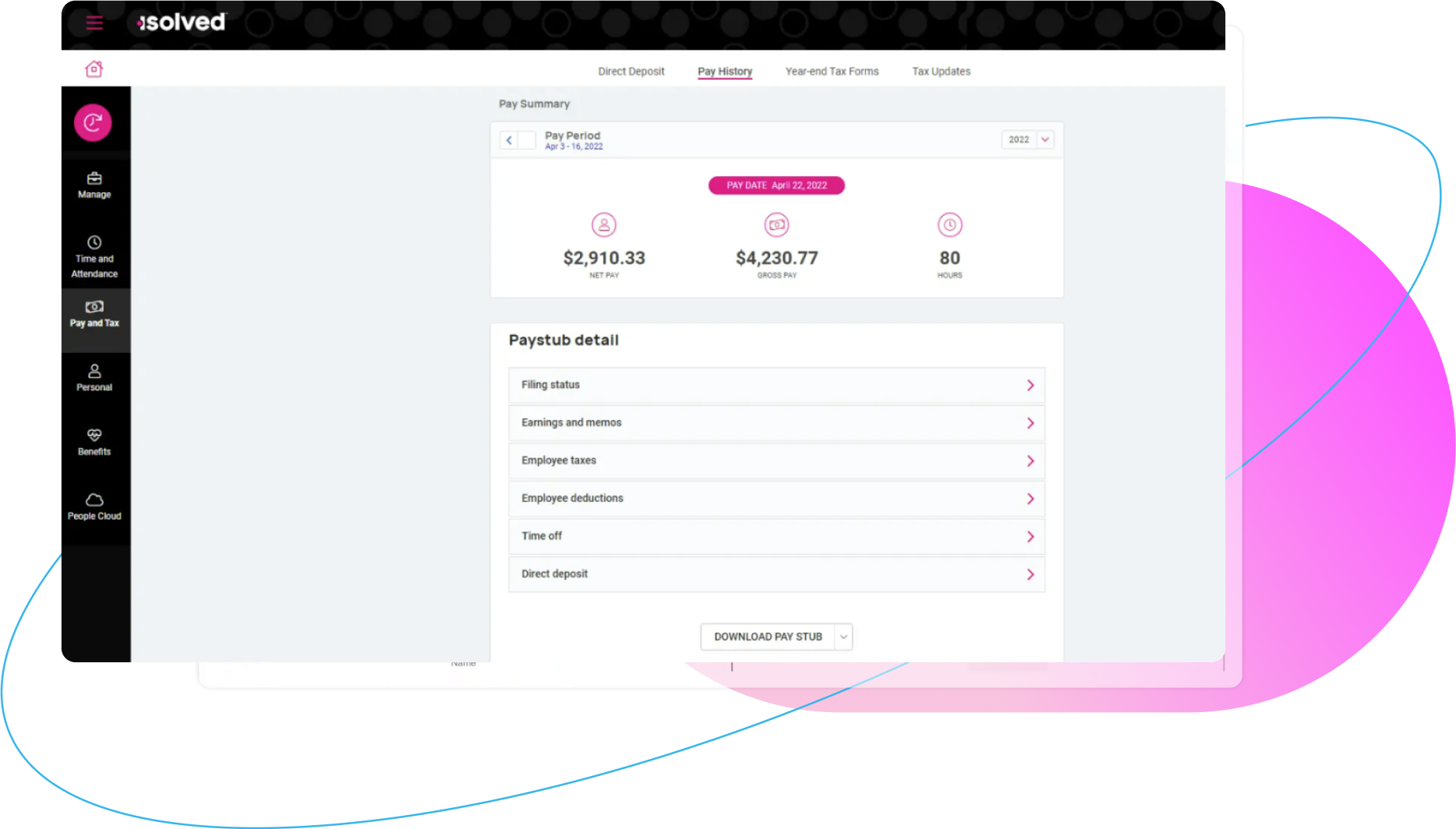

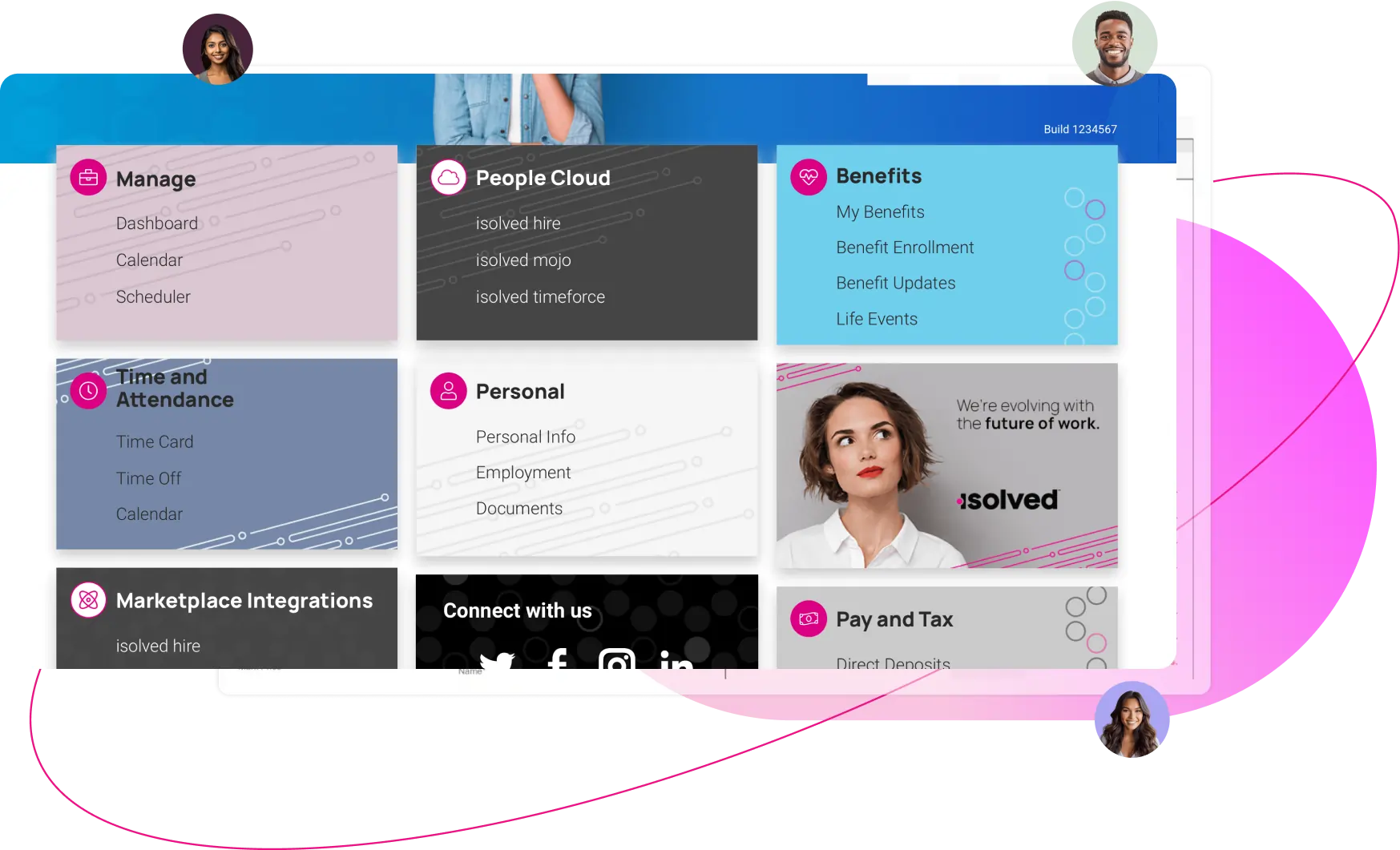

Tools Employees Love!

New Hire Onboarding

Tax Updates

Direct Deposit Updates

Employee Info

Any device…anywhere

Time & Attendance

Powerful Payroll to Meet Your Needs

User Friendly

AI-driven scheduling, turnover reduction, and seasonal hiring support.

Integrate with Third Party Data

AI-driven scheduling, turnover reduction, and seasonal hiring support.

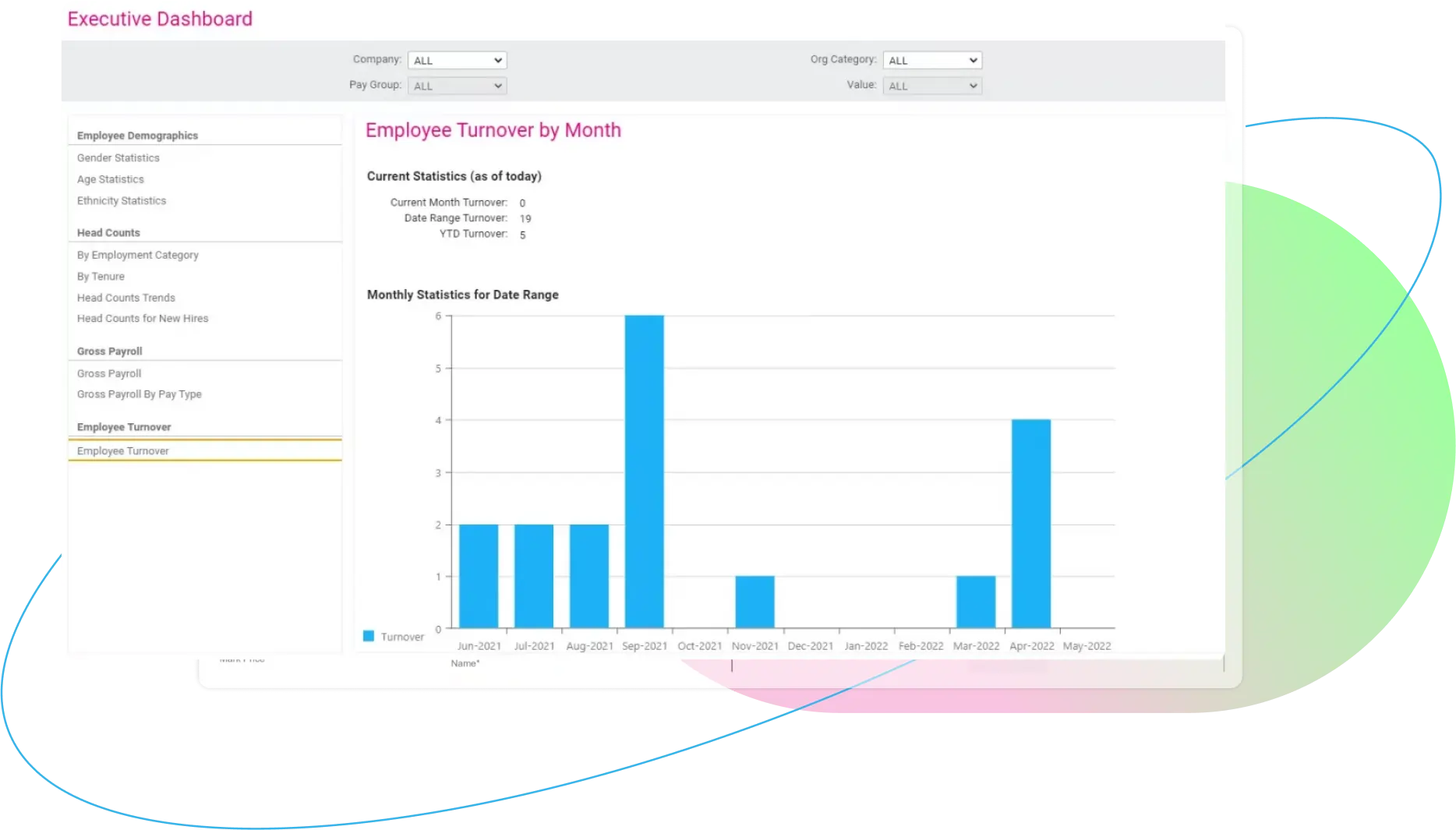

Powerful Reporting

AI-driven scheduling, turnover reduction, and seasonal hiring support.

Compliance Made Simple

W-2 / 1099 Filing

ACA Compliance

Quarterly Tax Reporting

Minimum Wage Compliance

New State Registrations