Retail margin isn’t usually lost in one big moment.

It disappears in small, repeated leaks.

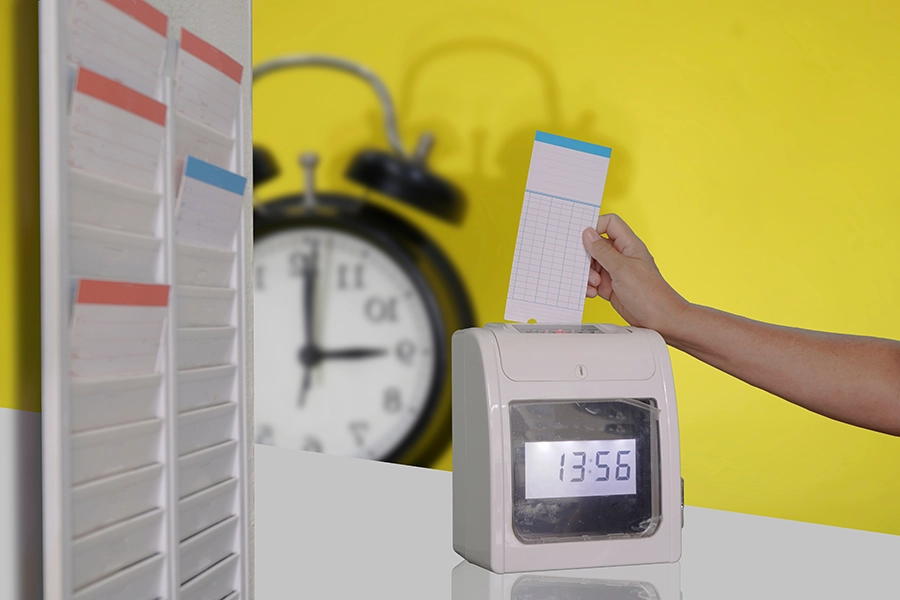

A few minutes of early clock-ins.

A manager approving overtime because closing ran long, again.

Missed meal breaks.

Time edits nobody reviews.

A forgotten clock-out that turns into a paid hour.

None of it feels dramatic. But across weeks, stores, and teams, it becomes a quiet margin killer.

POS–Payroll integration is how retailers stop those leaks at the system level, before they turn into payroll costs.

This post will show you how retailers use integration to:

- Reduce overtime creep

- Prevent time theft and labor leakage

- Improve payroll accuracy and compliance confidence

- Give managers real-time visibility (without adding admin)

Content

- Why Retail Overtime Is So Hard to Control (Even With Good Leadership)

- The Overtime Most Retailers Don’t Notice (Until It’s Too Late)

- What Time Theft Looks Like in Retail (And Why It’s Often a Process Issue)

- The Real Cost: Overtime + Time Theft = Margin Erosion

- Where the Margin Actually Gets Lost: The “Hand-Off Gap” Between POS and Payroll

- How POS–Payroll Integration Protects Store Margin (In Real Operations)

- The Operational Win: You Don’t Need More Control, You Need Better Guardrails

- What to Look for in a POS, Payroll Integration (Retail-Ready Checklist)

- Implementation Roadmap (How Retailers Roll This Out Without Disrupting Stores)

- Final Thoughts: Margin Protection Shouldn’t Depend on Manual Work

- FAQ: Retail Overtime, Time Theft & POS, Payroll Integration

Why Retail Overtime Is So Hard to Control (Even With Good Leadership)

Retail is unpredictable by design.

It’s labor-heavy, customer-driven, and constantly shifting.

Even strong managers struggle to control overtime because:

- Foot traffic spikes without warning

- Employees call out

- Coverage gaps force longer shifts

- “Just stay a little longer” becomes routine

- Manual time tracking and approvals happen after the cost is incurred

The result is what most retail operators experience:

Overtime becomes reactive, not managed.

The Overtime Most Retailers Don’t Notice (Until It’s Too Late)

Overtime isn’t always a big time-and-a-half event.

It’s usually overtime creep.

Common examples:

- Clocking in 10–15 minutes early “to get ready”

- Staying late to finish closing tasks

- Opening tasks that consistently run over

- Double shifts to cover call-outs

- Missed breaks that trigger compliance premiums

Each one might only add a few dollars.

But overtime creep is dangerous because it scales quietly.

If you’re running multiple stores, it becomes a margin drift, store by store, pay period by pay period.

What Time Theft Looks Like in Retail (And Why It’s Often a Process Issue)

Time theft isn’t always malicious.

It often happens because the system allows it.

In retail, time theft typically shows up as:

- Buddy punching (clocking in for someone else)

- Missed punch-outs that get “fixed” later

- Extended breaks

- Clocking in early then waiting to work

- Timecard edits without clear reasons or logs

- Rounding that consistently favors employees

When time and payroll systems aren’t connected, accountability becomes manual, and manual systems create gaps.

The Real Cost: Overtime + Time Theft = Margin Erosion

Retail leaders often track labor as a percentage of sales.

But labor leakage is not always obvious on the surface.

Here’s why it matters:

- Every untracked time exception becomes a payroll cost

- Every time edit creates an accuracy risk

- Every missed break becomes a compliance exposure

- Every minute of unapproved overtime becomes margin loss

The issue is not that retailers don’t care.

The issue is that manual workflows can’t enforce discipline at scale.

Where the Margin Actually Gets Lost: The “Hand-Off Gap” Between POS and Payroll

Most labor waste happens in the gap between:

- What the store is doing (POS activity + scheduling reality)

and - What payroll receives (hours, edits, approvals, premiums)

When systems are disconnected:

- Managers don’t see labor drift until payroll closes

- Payroll teams chase missing punches and unapproved overtime

- Exceptions become normalized because fixing them is harder than preventing them

- You lose control of the labor narrative

Integration closes that gap.

How POS, Payroll Integration Protects Store Margin (In Real Operations)

POS–Payroll integration works because it reduces “maybe” and replaces it with rules, visibility, and accountability.

1) It enforces clock-in rules automatically

Instead of relying on manager memory or manual policing:

- Employees can clock in only within an allowed window

- Early or late punches require approval

- Exceptions are visible immediately

This prevents overtime creep before it starts.

2) It connects schedule reality to payroll reality

Stores don’t lose margin because people worked.

They lose margin because they worked outside plan, and nobody saw it in time.

With integration:

- Schedule vs. actual hours can be compared automatically

- Variances are flagged

- Managers can adjust coverage sooner

- Payroll gets clean, approved data

Less surprise overtime at payroll time.

3) It reduces timecard edits (and improves accountability)

Manual edits are where:

- errors happen

- fraud hides

- disputes begin

- inconsistency spreads

Integrated workflows can require:

- a reason for each edit

- manager approval

- audit logs that track who changed what and when

Fewer payroll errors and fewer employee disputes.

4) It makes break compliance trackable, not theoretical

Break compliance is one of those areas retailers intend to handle well, until the shift gets busy.

Integrated systems help:

- track meal and rest breaks

- alert managers to missed breaks

- apply payroll rules properly when premiums are required

Lower compliance exposure and cleaner documentation.

5) It turns labor reporting into something you can act on

Disconnected systems create after-the-fact reporting.

Integrated systems create:

- real-time alerts

- trend dashboards

- store comparisons

- manager-level accountability signals

- forecasting inputs tied to POS activity

Managers can manage, not just respond.

The Operational Win: You Don’t Need More Control, You Need Better Guardrails

Retail leaders don’t want to micromanage time.

They want consistency.

POS, Payroll integration creates the guardrails:

- approved hours only

- exceptions with clear approvals

- audit trails

- standardized rules across stores

- cleaner payroll cycles

And here’s the overlooked benefit:

Employees trust payroll more when it’s accurate and consistent.

That reduces questions, disputes, and dissatisfaction.

What to Look for in a POS, Payroll Integration (Retail-Ready Checklist)

If you’re evaluating integration options, prioritize real control, not just data syncing.

Must-have capabilities:

- Automated sync from timekeeping → payroll

- Overtime approvals and exception workflows

- Break tracking

- Edit reason requirements + audit logs

- Role-based permissions (manager vs HR vs payroll)

- Real-time alerts for variance and overtime risk

- Multi-location reporting

- Easy clock experience (kiosk/mobile)

Implementation Roadmap (How Retailers Roll This Out Without Disrupting Stores)

Integration doesn’t have to be disruptive.

It should be phased and measurable.

Step 1: Identify your highest-leak areas

Start by reviewing:

- overtime by store

- missed punches

- time edits by manager

- break violation patterns

Step 2: Define your labor enforcement rules

Examples:

- clock-in windows

- overtime approval requirement

- break rules

- edit thresholds and required reasons

Step 3: Pilot in one store or region

Choose a pilot location with:

- stable staffing

- strong manager engagement

- clear baseline data

Measure:

- overtime change

- edit frequency

- payroll processing time

- employee pay accuracy disputes

Step 4: Expand with training and policy clarity

Don’t just “install” integration.

Train:

- how to approve exceptions

- how to prevent unplanned overtime

- what dashboards matter

- what policies are enforced

Step 5: Use the data to optimize scheduling and staffing

Once hours are clean:

- improve forecast accuracy

- match staffing to peak windows

- reduce coverage padding

- track efficiency per labor hour

Final Thoughts: Margin Protection Shouldn’t Depend on Manual Work

Overtime and time theft aren’t just “people issues.”

They’re systems issues.

When POS, timekeeping, and payroll are disconnected, labor costs drift and payroll becomes reactive.

But when the systems work together:

- overtime becomes visible early

- time theft becomes harder

- payroll gets cleaner inputs

- managers stop guessing

- and margin stops leaking quietly

POS, Payroll integration protects store margin by design.

If overtime creep and time theft are affecting store margin, the fastest fix is better guardrails, built into payroll and timekeeping workflows.

FAQ: Retail Overtime, Time Theft & POS, Payroll Integration

1) What is POS, payroll integration in retail?

POS, payroll integration connects time and labor data from store operations into payroll processing. It helps ensure clock-ins, breaks, and approvals are captured accurately and transferred into payroll without manual re-entry.

2) How does POS, payroll integration reduce overtime?

It reduces overtime by enforcing clock-in rules, flagging schedule variances early, and requiring approvals for exceptions before overtime becomes a payroll expense.

3) What are common examples of time theft in retail?

Common examples include buddy punching, early clock-ins, extended breaks, forgotten clock-outs, and timecard edits without oversight. Some cases are intentional, but many are caused by weak systems.

4) Can POS, payroll integration help prevent buddy punching?

Yes. Integrated systems often support unique logins, approval workflows, and audit logs that make buddy punching harder to do without detection.

5) Why do retailers struggle with missed punches and timecard edits?

Because store operations move fast and managers prioritize coverage. Without automated safeguards, exceptions get fixed after the fact, creating error risk and inconsistent enforcement.

6) Does integration help with break compliance?

It can. Break tracking and alerting helps managers identify missed breaks in real time and supports cleaner compliance documentation.

7) How long does it take to implement POS, payroll integration?

Implementation depends on store count and complexity, but many retailers start with a pilot store or region and expand once rules and workflows are validated.

If you need help with workforce management, please contact PeopleWorX at 240-699-0060 | 1-888-929-2729 or email us at HR@peopleworx.io

Dealing with an HR issue right now? Get HR guidance before it goes wrong.

Retail Overtime & Time Theft: What’s Your Exposure?

Retail Overtime & Time Theft: How POS and Payroll Integration Protects Store Margin” shows how syncing POS and payroll curbs overtime abuse and time theft. See your exposure.

Take Your HR Risk Assessment →