Managing payroll is a critical yet complex function for small businesses, especially startups. Beyond issuing paychecks, it involves compliance with tax regulations, tracking employee hours, managing benefits, and ensuring accuracy in financial reporting. While manual payroll processing was once the norm, today’s businesses increasingly rely on automated payroll systems to streamline these tasks, reduce errors, and enhance efficiency.

Content

- What is an Automated Payroll System?

- Case Study: The Growing Digital Agency

- Key Components of an Automated Payroll System

- How do Automated payroll Systems Work?

- Key benefits of Automated Payroll Systems

- Enhanced Accuracy & Compliance

- Cost Saving & Scalability

- Manual Payroll vs. Automated Payroll

- Choosing the Right Payroll System for Your Small Business

- The Future of Automated Payroll Solution

What is an Automated Payroll System?

An automated payroll system is a technology-driven solution that simplifies and digitizes payroll processing. Instead of manually calculating wages, deductions, and tax withholdings, these systems automate the process using pre-set parameters, ensuring accuracy, compliance, and efficiency.

For businesses operating with limited HR staff or those subject to strict labor laws, an automated system can mitigate risks while freeing up time for strategic workforce management.

Case Study: The Growing Digital Agency

A digital marketing firm with remote employees in multiple states struggled to track state-specific tax requirements. After switching to an automated payroll system, they:

-

-

- Accurately handled multi-state tax compliance without manual calculations.

- Avoided penalties from misfiled tax withholdings.

-

- Improved financial forecasting by integrating payroll with accounting software.

-

Key Components of an Automated Payroll System

Most payroll systems integrate several core functions to ensure seamless payroll management:

-

-

- Time and Attendance Tracking: Syncs with timekeeping tools (e.g., biometric scanners, and online timesheets) to calculate hours worked.

- Automatic Salary Calculation: Computes gross pay based on hourly wages, salaried contracts, and overtime rules.

-

- Tax Withholding & Compliance: Applies deductions based on federal, state, and local tax regulations, updating rates as laws change.

- Direct Deposit Processing: Automates salary payments via bank transfers, reducing reliance on paper checks.

- Employee Self-Service Portals: Provides employees with online access to pay stubs, W-2s, and tax documents.

- Benefits and Deductions Management: Calculates health insurance, retirement contributions, and other employee deductions.

- Reporting & Analytics: Generates reports for audits, financial planning, and tax compliance.

-

How Do Automated Payroll Systems Work?

Automated payroll systems function by integrating various data points to calculate and process employee compensation seamlessly. Here’s an overview of the workflow:

-

- Data Collection: Employee hours, salary details, and benefits information are gathered from integrated systems (e.g., Point of Sale systems).

- Payroll Calculation: The system determines gross pay, applies deductions for taxes, benefits, and other withholdings, and calculates net pay.

- Tax Compliance Processing: The system applies current tax regulations, ensuring accurate withholdings and reducing compliance risks.

- Salary Distribution: Payments are processed via direct deposit, payroll cards, or printed checks.

- Reporting & Recordkeeping: The system generates reports for accounting, audits, and tax filings, maintaining necessary payroll records.

Key Benefits of Automated Payroll Systems

Increased Efficiency & Time Savings

Payroll processing that once took hours or even days can now be completed in minutes. Automated systems:

-

-

- Handle tax calculations and withholdings instantly.

- Generate pay stubs and tax forms without manual input.

-

- Ensure seamless direct deposit processing for all employees.

-

Enhanced Accuracy & Compliance

Manual payroll processing carries a high risk of calculation errors that can lead to underpayments, overpayments, or compliance violations. An automated system helps by:

-

-

- Applying real-time tax updates to ensure payroll compliance.

- Flagging inconsistencies before payroll is processed.

-

- Generating audit-ready reports to simplify tax filing.

-

Cost Saving & Scalability

While an initial investment is required, the long-term cost savings are significant. Businesses can:

- Reduce the need for additional HR staff.

- Avoid costly penalties for payroll miscalculations.

- Scale efficiently as the workforce grows without increasing administrative burdens

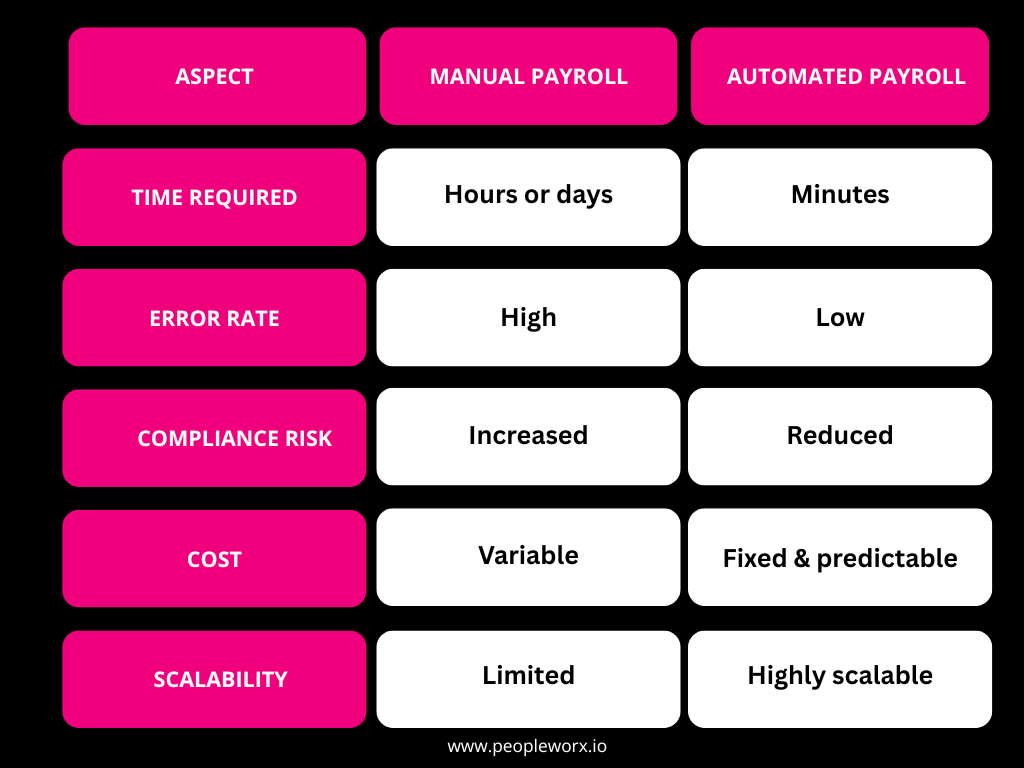

Manual Payroll vs. Automated Payroll: A Comparative Analysis

For businesses looking to enhance payroll accuracy, ensure compliance, and save time, transitioning from manual to automated payroll is a logical step.

Choosing the Right Payroll System for Your Small Business

When evaluating payroll solutions, consider:

-

-

- Integration Capabilities: Syncing with time-tracking, benefits, and accounting software.

- Scalability: Adapting to business growth and multi-state tax compliance.

-

- Ease of Use: Intuitive platforms for HR teams and employees.

- Tax Compliance Features: Automatic federal, state, and local tax rate updates.

- Security & Data Protection: Safeguarding payroll data from fraud and breaches.

-

The Future of Automated Payroll Solutions is Workforce Management

As businesses adapt to an evolving workforce landscape, payroll automation is no longer a luxury, it’s a cost of doing business. When selecting an automated payroll system for your small business, it’s crucial to consider solutions that not only streamline payroll processes but also enhance overall workforce management solutions.

PeopleWorX helps small businesses with everything from payroll to workforce management strategies. Our team has deep expertise in payroll and HR. We aim to stay current with the constantly evolving legal and regulatory landscape to ensure your company remains compliant. Our workforce solutions encompass all aspects of employee lifecycle management, from initial hiring to retirement. We offer customized assistance designed to address the specific requirements of your organization.