Payroll and HR Solutions for Nonprofit Success

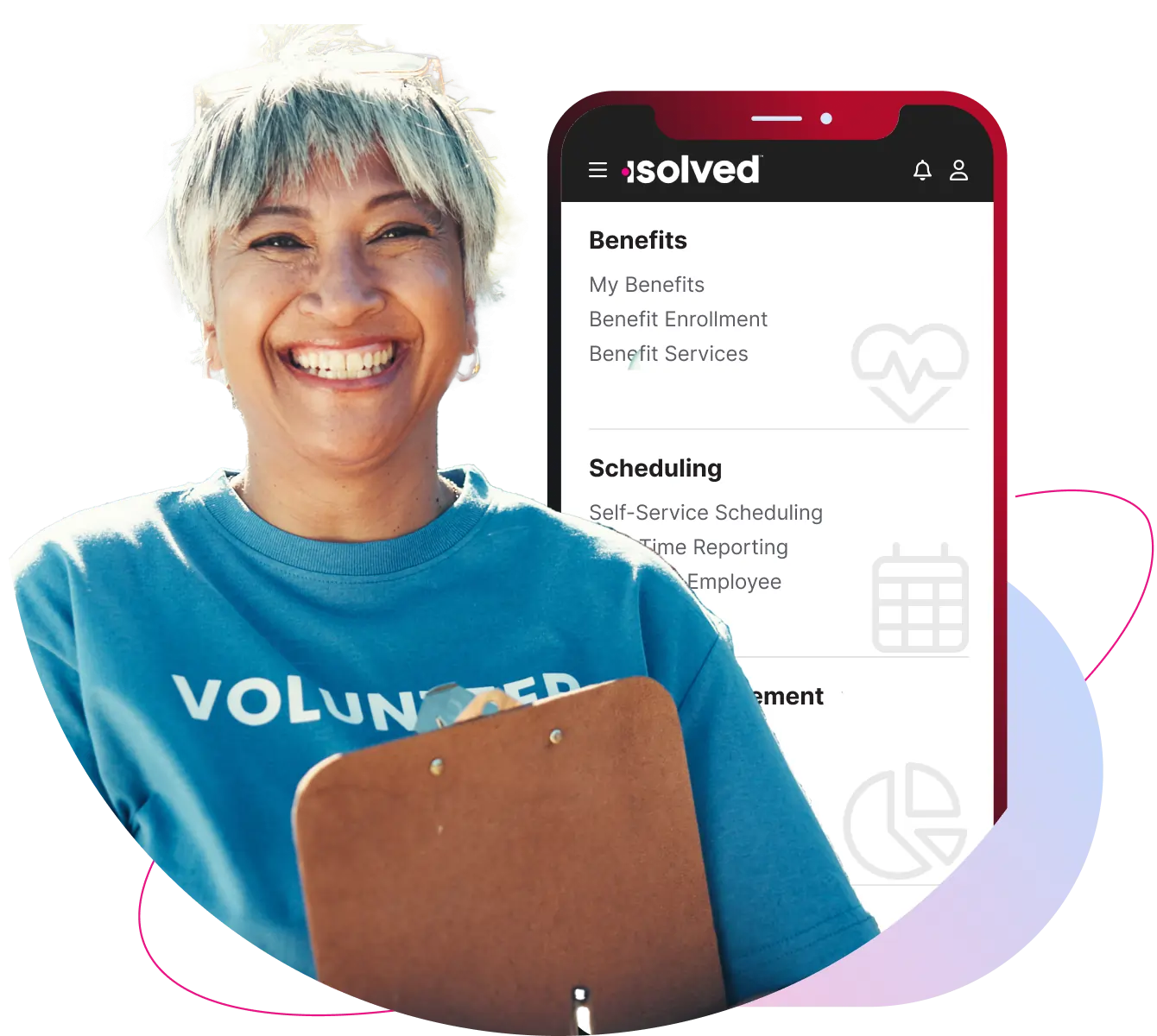

Empower your mission with PeopleWorX. Our People Matter solutions make payroll, HR, and compliance simple, so you can focus on impact instead of paperwork. From managing grants and donor-funded budgets to supporting staff and volunteers, our platform scales to meet the unique needs of your nonprofit organization.

Non-profit Service

We understand that managing people and payroll in a nonprofit organization comes with distinct responsibilities. From balancing grant-funded roles and restricted budgets to navigating volunteer coordination, board oversight, and ever-changing compliance requirements, nonprofit leaders wear many hats, often with limited resources.

At PeopleWorX, we support mission-driven organizations with practical, people-first solutions that simplify payroll, streamline HR administration, and ensure compliance without overwhelming your staff. Our technology and expert support are here to help you protect your mission, and the people behind it.

Contact Us For More Information or to Schedule a Free Consultation

Customer Success Story

Community Living, Inc.

Empowering Lives Through Service, Supported by PeopleWorX

Employees: 200+

Locations: 2 campuses with multiple group homes in Frederick, MD

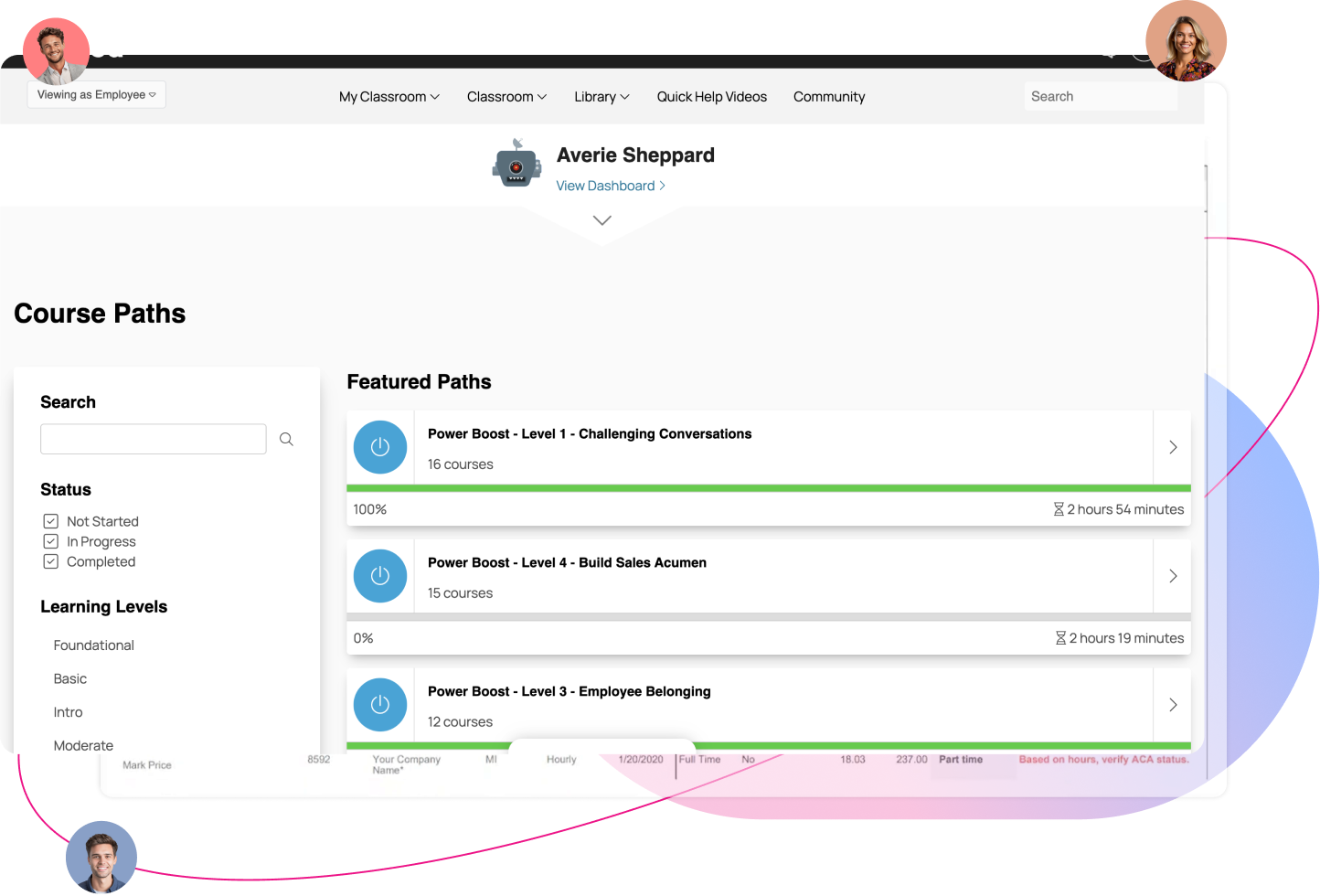

Solution Set: Payroll, Timekeeping, General Ledger Integration, Learning Management System (LMS)

Key Results

- Seamless handling of complex nonprofit payroll needs

- Compliant time and labor allocations for 150+ clients

- Reliable reporting for state audits and executive oversight

- Streamlined management of employee training and certifications

- Consistent, personalized support from a dedicated account representative

“ PeopleWorX has been with us for more than six years, helping us navigate the complexity of nonprofit payroll, compliance, and staff training. What makes the biggest difference is the personalized support, we always have someone who understands our unique needs. Even when there’s turnover on their side, the knowledge transfer is seamless. PeopleWorX gives us confidence that our operations are handled so we can focus on our mission. “

Fund Allocation:

We understand that one of the most important aspects of driving your nonprofit to success is managing your fund allocations, whether it is through government grants, donations, or fundraising.

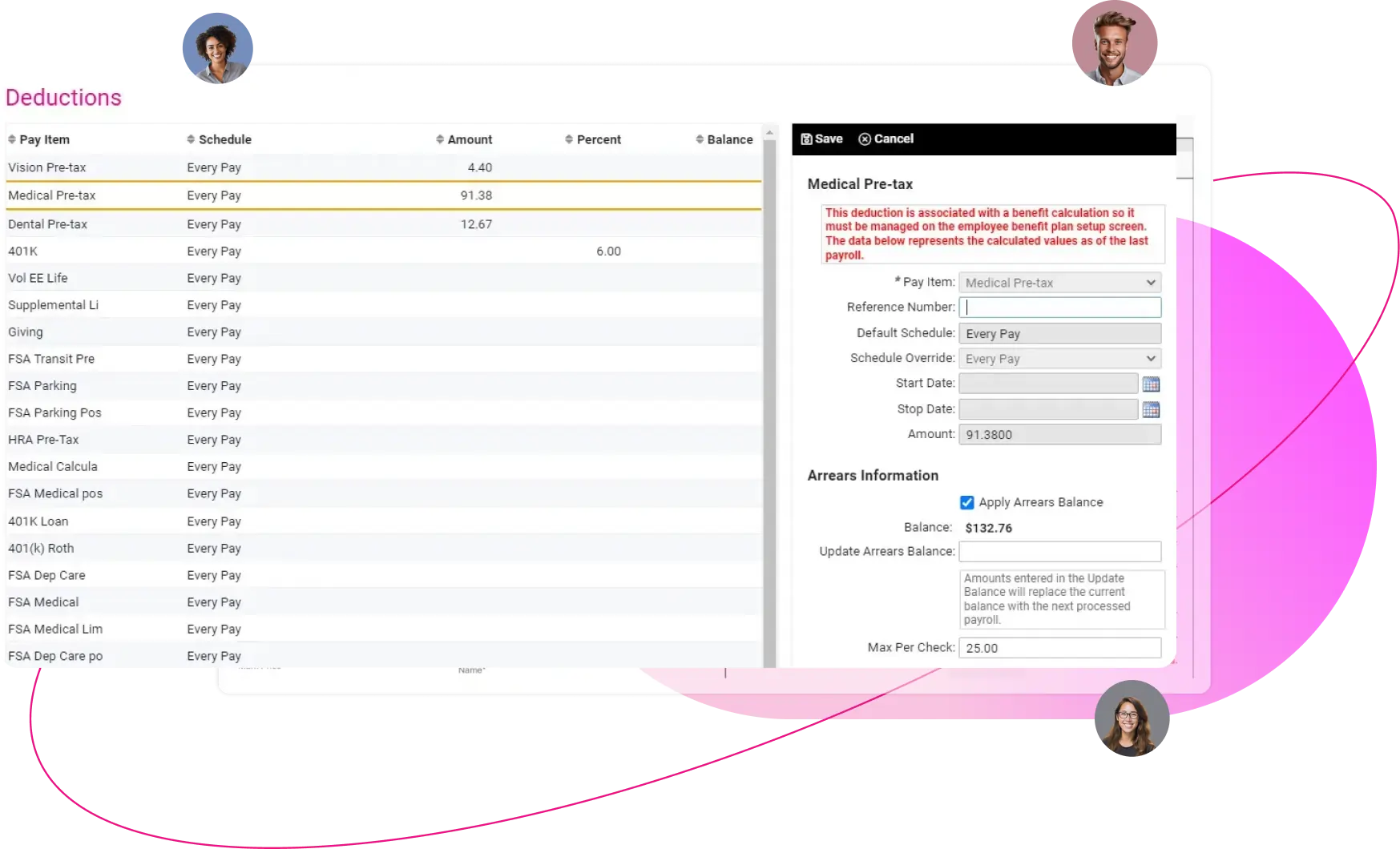

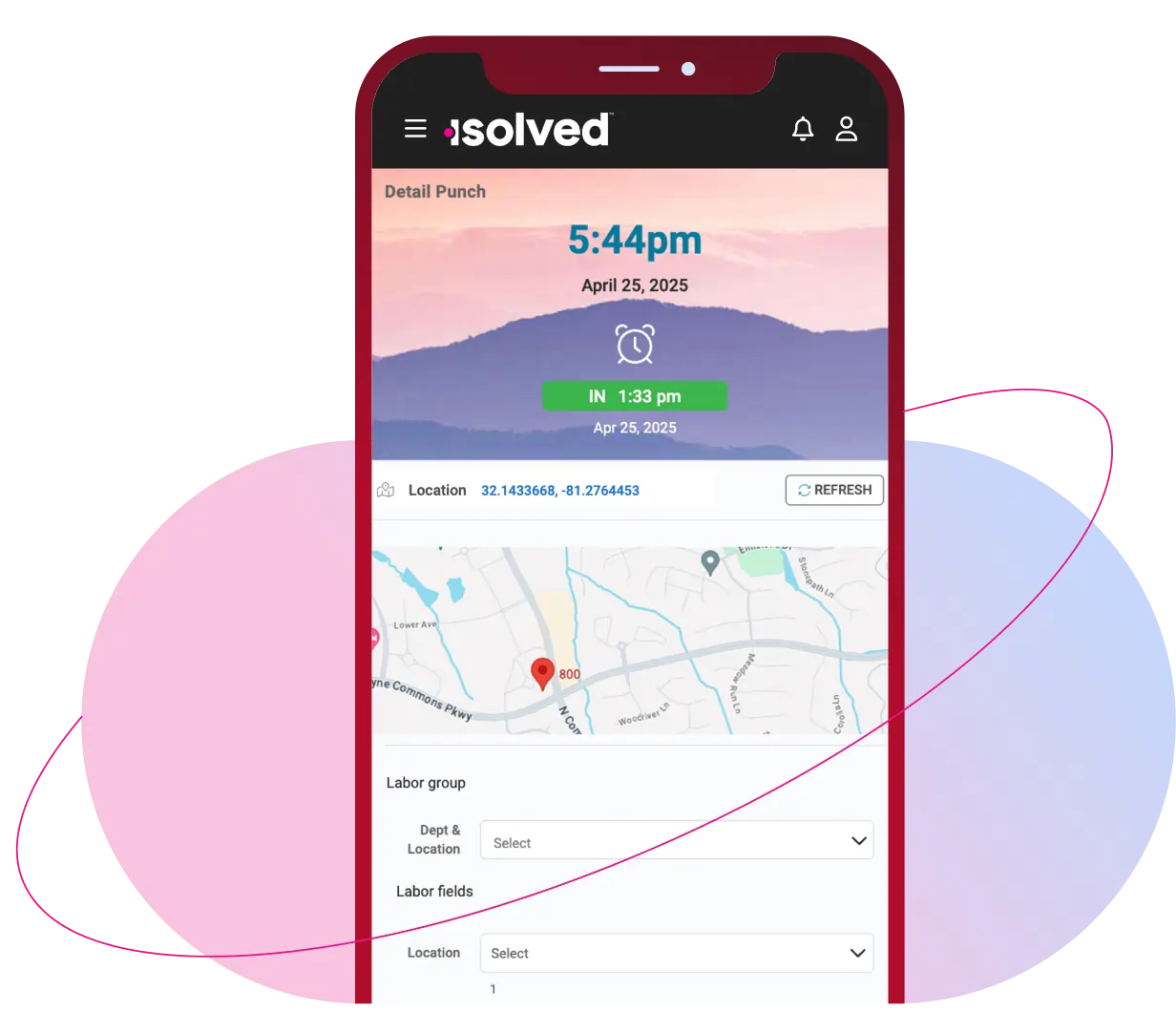

We help nonprofits do this through our specialized approach in allocating labor to these different cost centers through our time & attendance customizations and General Ledger (GL) Integrations.

Leverage on Unemployment Exemption

Most nonprofits can exempt themselves from FUTA (Federal Unemployment Taxes). It is a common misconception that nonprofits are exempt from the State Employment taxes (SUTA). Most states require nonprofits to choose between registering as a contribution or reimbursement-based account. PeopleWorX understands the difference and can help you with that.

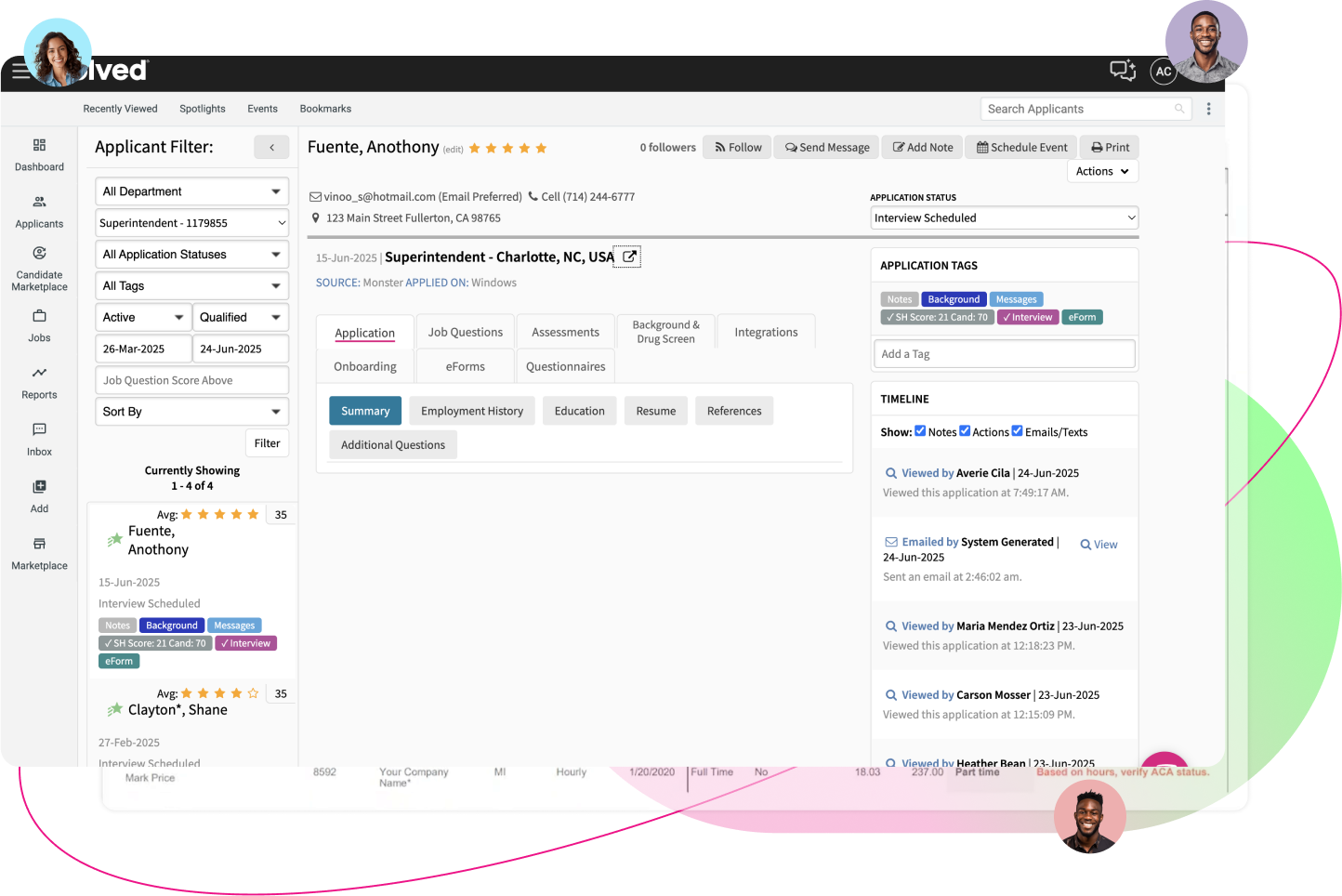

Keeping a Full Bench of Applicants

Certificate and Learning Management

Complete Tax Compliance

Our dedicated team is here to support your mission by helping you stay compliant with labor laws and regulations. We continuously monitor changes in the nonprofit and employment landscape to keep your organization informed and aligned with the latest requirements.

W-2 / 1099 Filing

ACA Compliance

Quarterly Tax Reporting

Minimum Wage Compliance

New State Registrations