Strategic Workforce Management Solutions for the

Unique Needs of Construction Business

Solutions for

Construction Business

Our award winning technology makes running payroll and handling taxes simple. As your Business scales, so can we!

We understand that construction payroll is different from most industries – ranging from accounting to paying employees.

PeopleWorX can help you with your unique needs and provide strategic yet measurable solutions to manage construction workforce management.

Valerie O’Connor

Specialized Construction Business Solutions

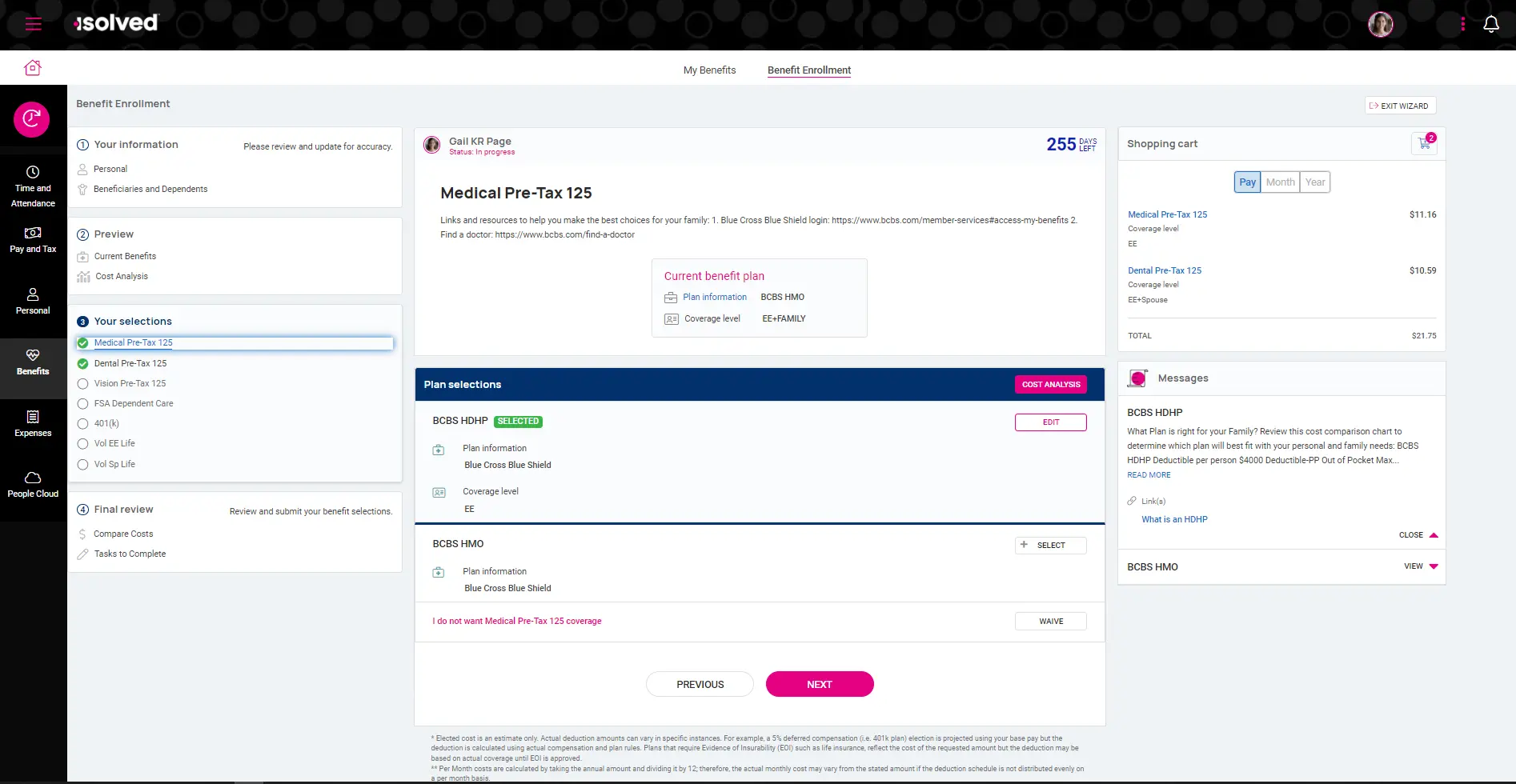

Seamless Integration with Certified Payroll and LCP Tracker

We understand most construction companies run a weekly payroll due to certified payroll requirements and record daily hours, employee deductions, employee taxes, employee classification, projection location, and the prevailing wage. Some contracts may require the construction company to report their Certified Payroll through programs such as LCP Tracker or a proprietary state system like Maryland requires.

PeopleWorX can easily integrate with both Certified Payroll Systems and make the entire process hassle-free. Construction companies are required to provide data on a daily basis and are recommended to utilize a timekeeping system to ease the administrative burden.

Easily Manage Your Weekly Payroll

Most construction companies run payroll on a weekly basis. This is because construction employees are accustomed to receiving weekly paychecks, and it eases their transition to a new company. Certified payroll requires weekly payroll for reporting purposes.

Help with Mandatory Employee Work Eligibility Audits

We understand that employee verification is an important aspect of construction companies, safeguarding businesses from compliance issues. Sometimes, companies use I-9 and E-verify interchangeably and run into compliance issues. PeopleWorX can guide you and help you with the right process.

In some cases, companies use ITIN and SSN interchangeably. ITIN is an individual TAX Identification Number, and SSN is a Social Security Number which can be considered a verification number.

PeopleWorX can guide you through the employee verification process and keep you out of compliance issues.

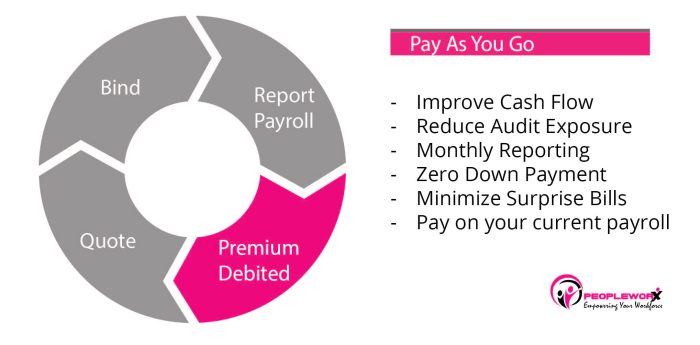

Eliminate surprise audit bills and manage better cashflow with Pay-As-You-Go

As a nature of the industry, construction payroll may experience a spike in labor, which in turn adds up on the workers’ comp. With Pay-As-You-Go, you can eliminate the down payment and pay for the premium only when the payroll is run.

PeopleWorX can help you with Pay-As-You-Go Workers’ Comp and help you manage better cashflow for your business.

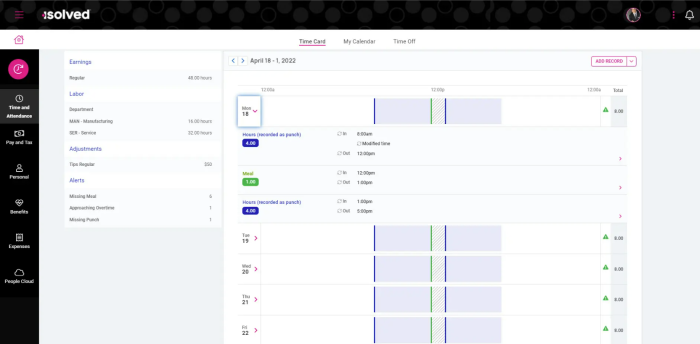

Enhanced Timekeeping Tracking

PeopleWorX’s Timekeeping system can help you with tracking employee hours, maintaining schedules, shifts and tracking PTO. We can also assist in job costing for hours.

Easily Integrate Job Costing with Your Accounting System

We understand that many construction companies require Job Costing. If you already have an accounting system in place like Quickbooks, PeopleWorX can easily integrate Job Costing with the accounting system and can help you eliminate errors. If your company use other systems like Jonas, Frontier, Foundation, Great Plains, Timberline etc., PeopleWorX can help you with custom reports that integrate with these programs reducing double entry.

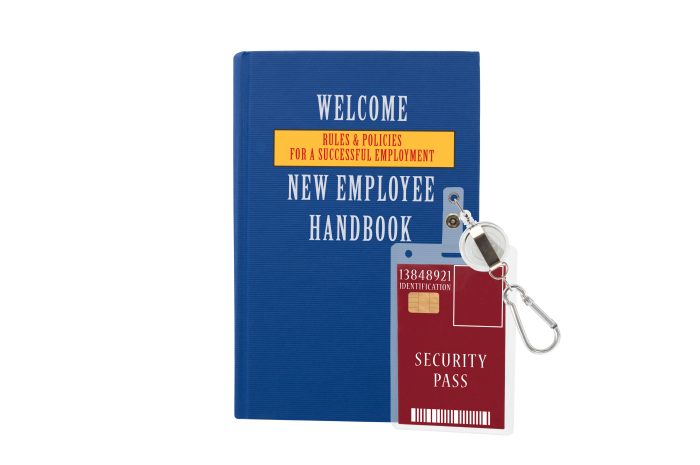

Effective Employee Hanbook creation to help with policies and cut unemployment Costs

We understand that construction businesses, like any business, need to have company policies in place to keep your employees and work environment safe and to safeguard you from legal complications.

With a solid employee handbook in place, construction companies can cut down on unemployment costs. The company should document all employee-related events. When an employee is terminated, the company can present a well-documented case with the necessary reason for terminating the employee.

Like the manufacturing business, construction will also have OSHA requirements. PeopleWorX can help you comply with OSHA procedures, creating or updating employee handbooks and company policies if you require them.

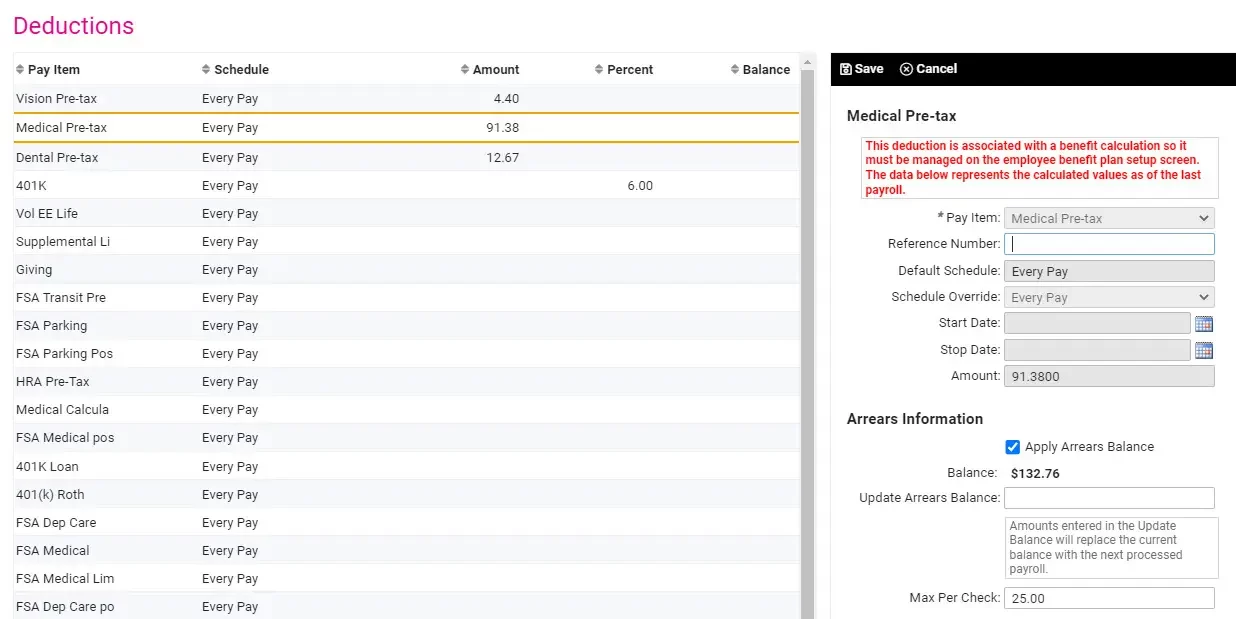

Manage Union Deductions and Union Benefits Easily

We understand the challenges construction payroll faces in administering Union Deductions and Union benefits. deductions and benefits have a wide variety of calculation methods ranging from per hour calculations to a flat dollar amount. Union deductions and benefits also require to be paid almost immediately to the Union Administrator. It is important to have these items implemented correctly with each new employee and have a streamline method to pay these amounts.

PeopleWorX can set these deductions and benefits up for you with an automated payment method.

Request for a demo to learn more.

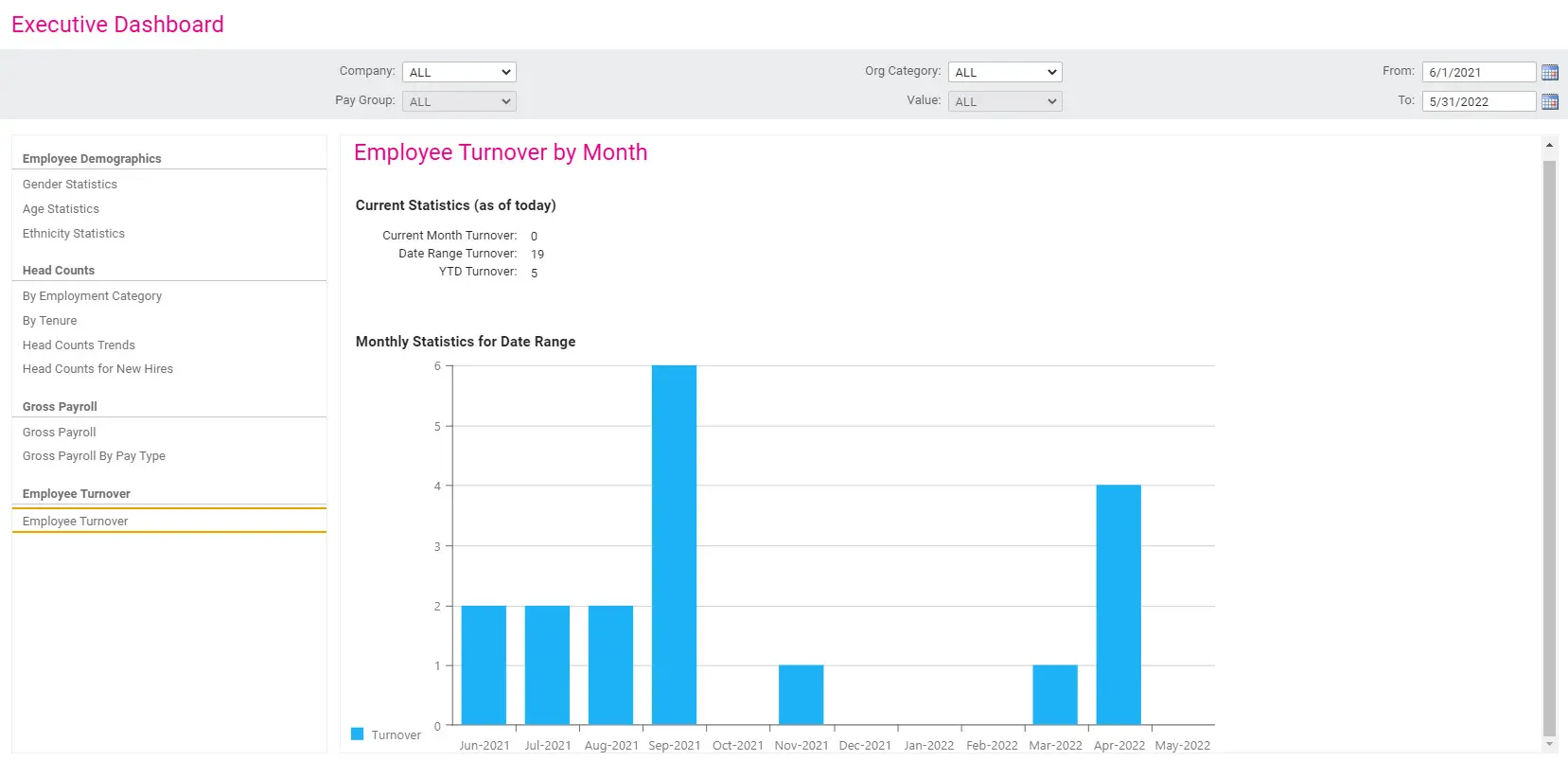

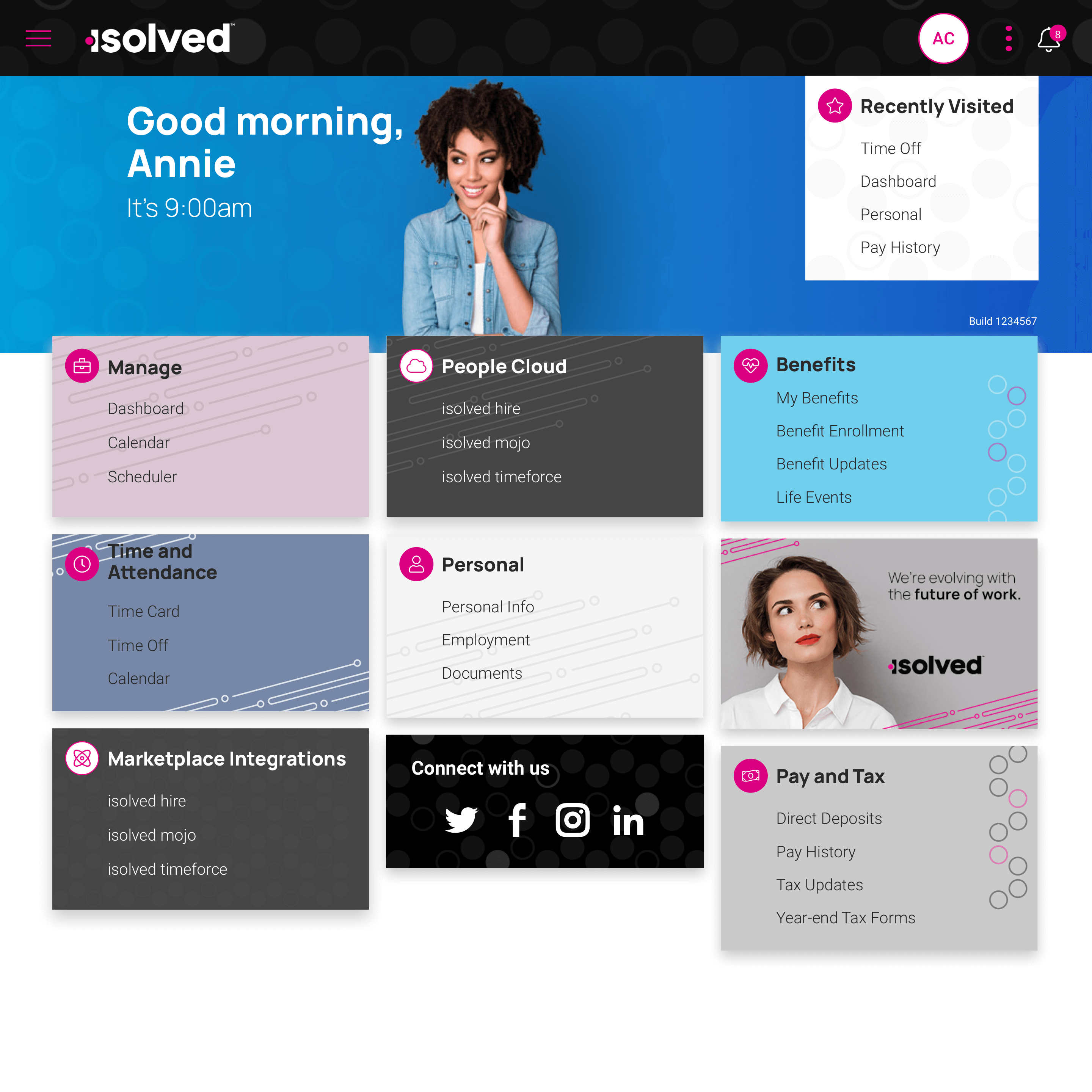

Tools Employees Love!

Empower your employees and reduce the day to grind with our award winning Employee Self Service.

Scott Mims

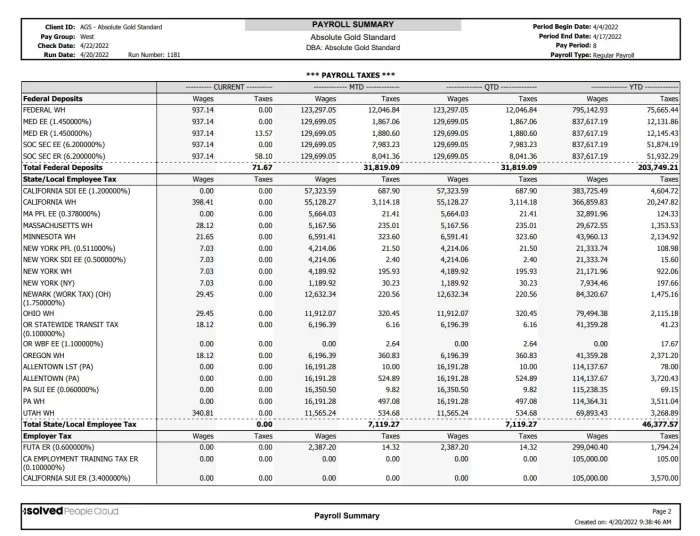

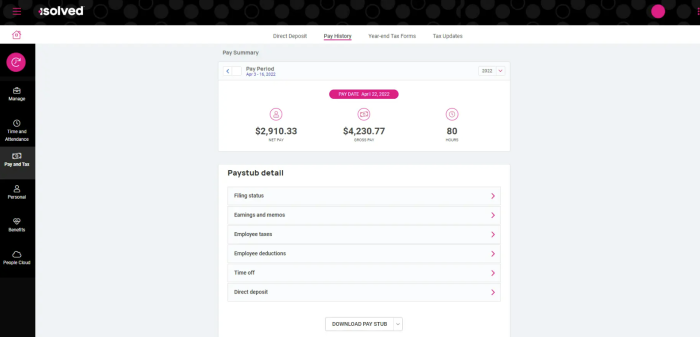

Powerful Payroll to Meet Your Needs

User Friendly

Integrate with Third Party Data

Powerful Reporting

Process payroll in the matter of minutes and let us take care of the hard part. Our Payroll Solution ensures you have the tools at your fingertips to let you do best… Your Business!

Complete Tax Compliance

Compliance Made Simple