Restaurant Payroll & HR That Scales With Your Growth

Our platform and consulting services makes payroll, HR, and compliance effortless while giving you the tools to manage shifts, control labor costs, and stay compliant with tip and wage regulations. From single-location cafes to multi-unit dining groups, we scale with your restaurant business to keep teams engaged and service running smoothly.

Workforce Management Made Simple

In the restaurant business, every shift counts. Whether you’re running a single location or expanding into a multi-unit operation, managing payroll (including multi-state payroll), scheduling, compliance, and HR tasks shouldn’t slow you down. But for many restaurants, the lack of a centralized HR team means owners and GMs are stuck wearing too many hats, especially when it comes to people operations.

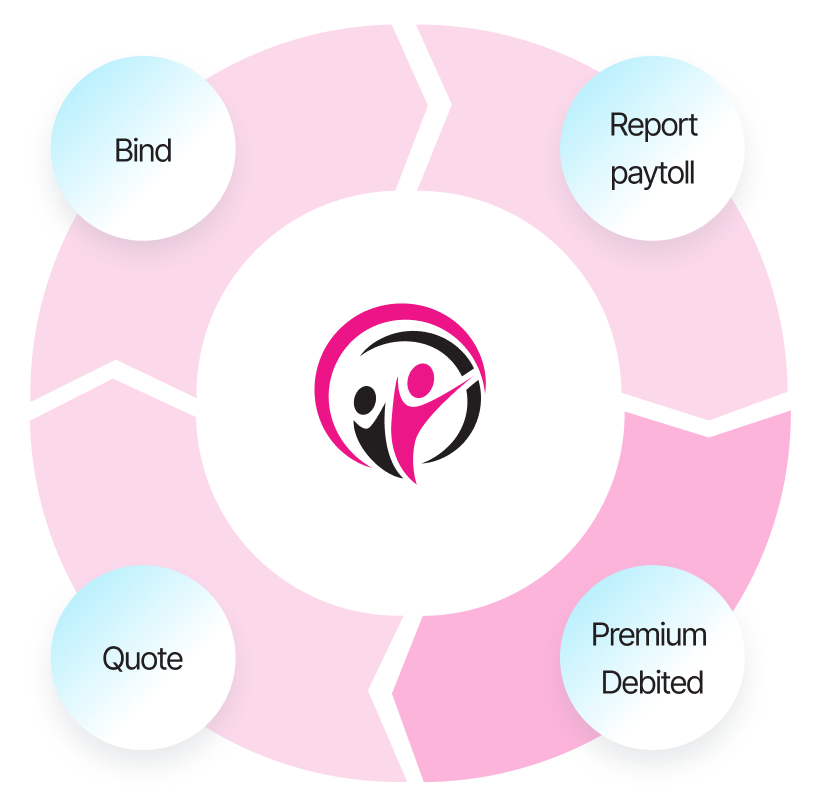

That’s where PeopleWorX comes in. We help restaurants streamline payroll, simplify onboarding, ensure tip and wage compliance, and stay audit-ready, all while supporting a better employee experience. From fast casual to fine dining, our technology and team are built to keep your back office running smoothly so you can focus on the front of house.

Contact Us For More Information or to Schedule a Free Consultation

Specialized Restaurant Services To Elevate Your Workforce Solutions

Are you receiving your FICA Tip Credit?

Restaurants get special credits for the payroll taxes paid for tips. Our services include FICA tip credit reporting at no extra cost.

We also provide tip sign-off reports, enabling employees to track the tips received during each payroll. This ensures that you remain compliant.

Claim WOTC Tax Credits Automatically with Smart Onboarding

Our HR platform makes it easy to capture Work Opportunity Tax Credits (WOTC) during the hiring process. As part of onboarding, new hires complete a quick questionnaire. PeopleWorX staff review responses and handle eligibility verification for you. If the hire qualifies, your business receives the credit. No extra steps. No manual tracking. Learn More

Automated WOTC Tax Credits

Tipped OT Calculations

Minimum Wage Alerts

Integrate with your POS

Variable Rates & Dept Allocation

FICA TIP Credit Reporting

Uncover Hidden HR Risk

Do you know how protected your business is from HR issues?

Take Your 30 Second HR Risk Assessment →See how clients are future-proofing their HR management.

I have been using this payroll service for over a year. I am very pleased with the ease of use. My customer service rep Jessica is the best. She gets back to me promptly and takes care of any need I may have. They truly make payroll easy. Highly recommend!

Retail

HR Manager

Our dedicated payroll specialist does a wonderful job communicating. They are great whenever there is an issue.

Construction

Office Manager

As an HR Manager in retail, reliable payroll is critical, and PeopleWorX has delivered exactly that. The payroll platform is straightforward and efficient, which saves me valuable time each pay period. I also appreciate the consistent support. Our rep is always responsive and makes sure questions are handled quickly. Having a payroll partner I can count on has made a noticeable difference, and I’m very happy with the service.

Retail

HR Manager

I’ve been with PeopleWorX for 6 months now and they do not disappoint! My specialist is so helpful and quick. He makes my life easier every time payroll comes around.

Healthcare

HR Director

Religious / Nonprofit

Office manager

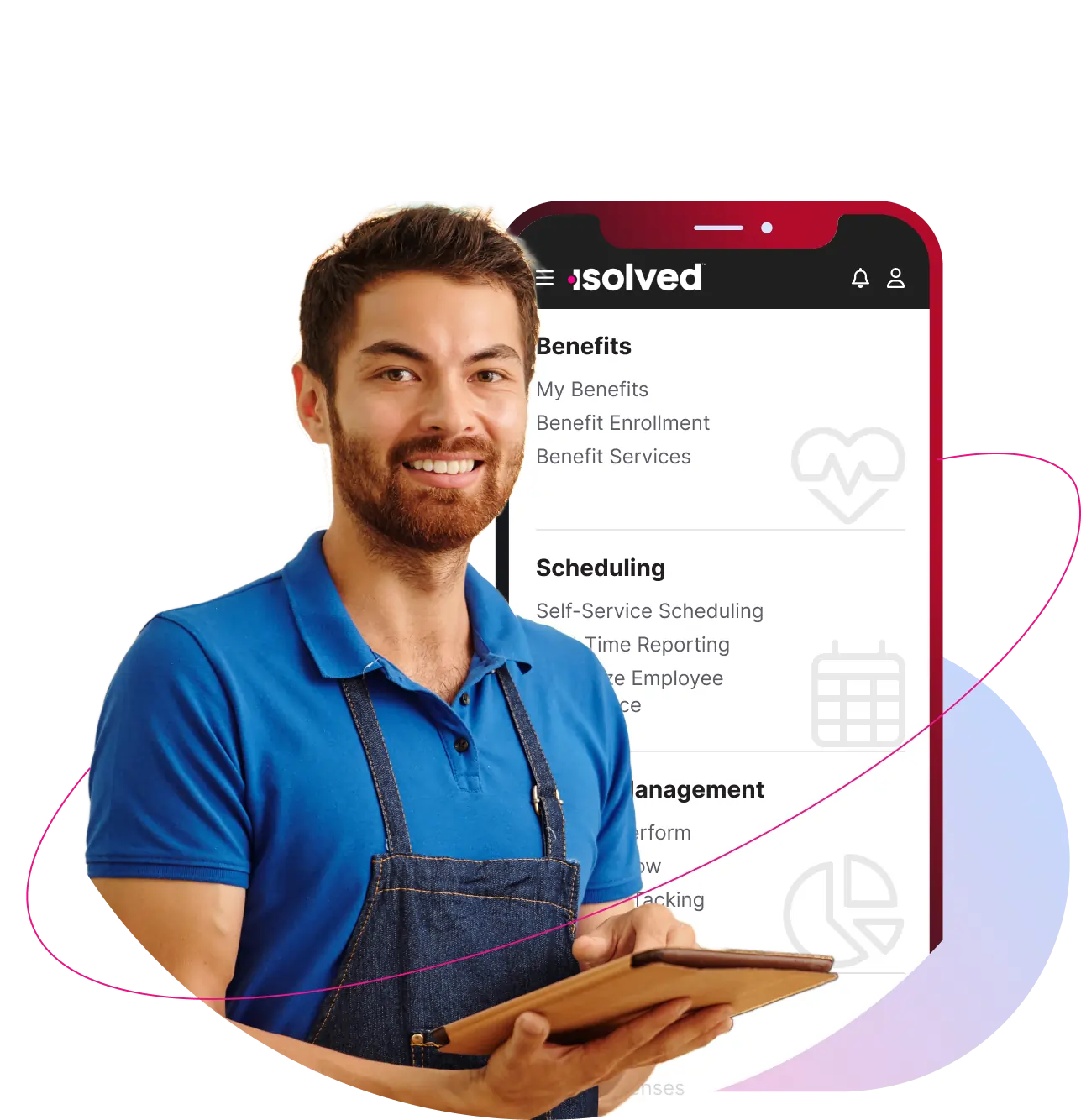

Simplify Restaurant Management with Seamless POS Integration

We understand how important your point-of-sale system is to your restaurant – and now, it can power your payroll and HR, too. By integrating your POS with our payroll and HRIS platform, you eliminate double entries, reduce errors, and streamline how you manage hours, tips, and employee data. From clock-in to payday, everything flows smoothly. When it’s time to run payroll, just click a button and your data is already where it needs to be.

Eliminate large down payment for your workers’ compensation insurance and minimize year-end adjustment with Pay As You Go Workers Comp?

In an industry with hourly wage employees, estimating restaurant workers’ compensation is always wrong and a hassle. With Pay As You Go, you will pay based on your current payroll.

This will help improve your cash flow as well as minimize any surprise bills at the end of your Workers Comp policy period.

Pay as you go

- Improve Cash Flow

- Reduce Audit Exposure

- Monthly Reporting

- Zero Down payment

- Minimize Surprise Bills

- Pay on Your Current Payroll

Empower Your Restuarant Workforce With More HR Tools

Easily Track Your Paid Time Off (PTO)

Tracking PTO not only helps with workforce management but is also a requirement in many States. Your POS may help with inventory and tracking employee hours, but most do not track PTO.

Our system allows us to build out state-required PTO mandates as well as any policy you may already use.

Enhance and Speed Up Your Training With Our Learning Management System

With the high turnover rate, training and development is an ongoing process in the restaurant business. The PeopleWorX Learning Management system makes creating training programs, tracking employee progress, and documenting completion easy and efficient.

Get Candidates Faster With Our Applicant Tracking System

Restaurants often experience high employee turnover due to the nature of the industry. Finding and retaining skilled and reliable employees can be a continuous challenge.

With PeopleWorX’s Applicant tracking system, you can post jobs and always maintain a pool of candidates when needed. Integrated onboarding helps with collecting new hire information and compliance documentation.

Complete Tax Compliance

Our knowledgeable team supports restaurant owners in staying compliant with labor laws, wage regulations, and industry standards. We stay up to date on evolving policies and keep you informed, so you can focus on running your restaurant while we help you navigate the complexities of workforce compliance.

W-2 / 1099 Filing

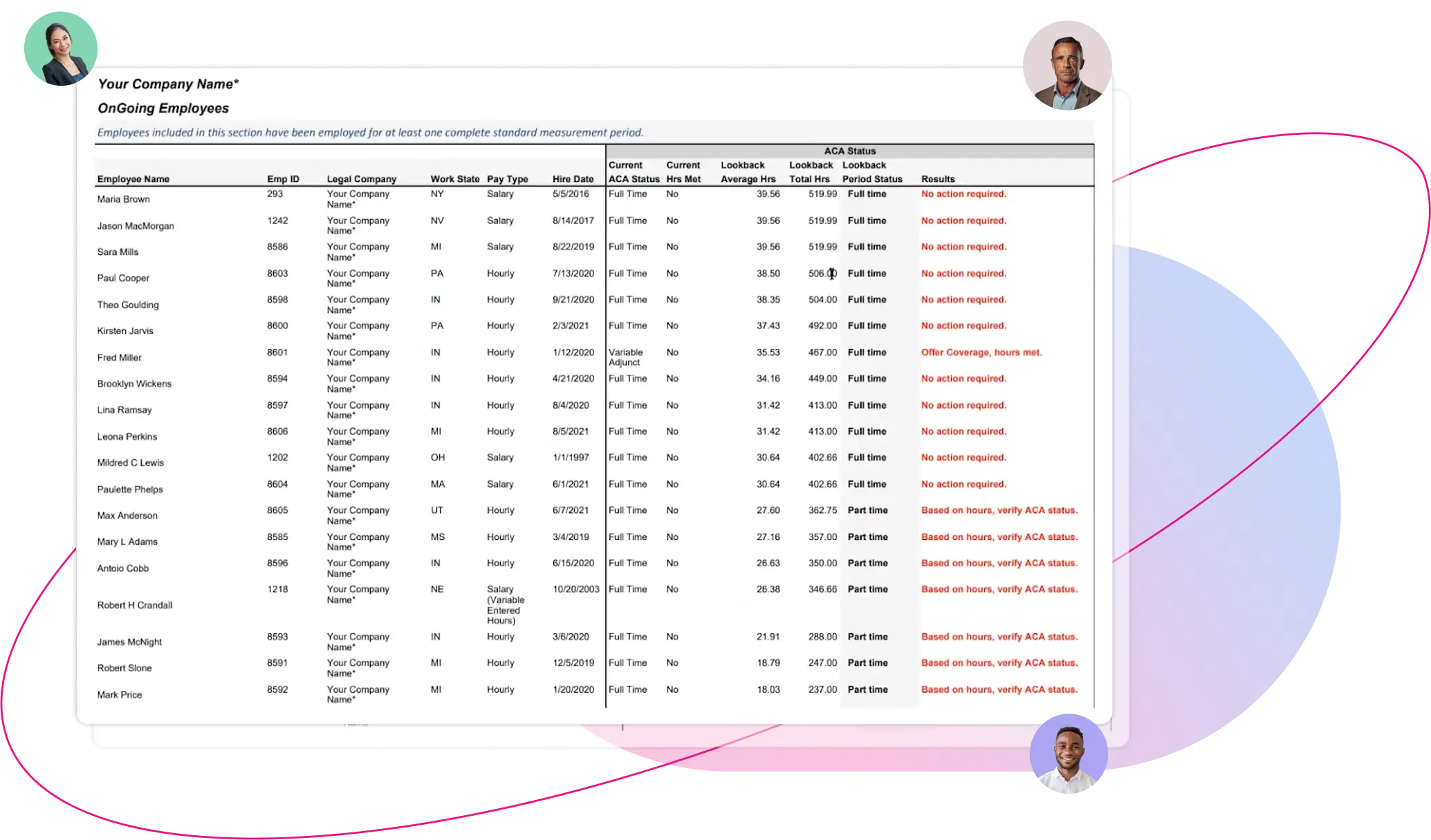

ACA Compliance

Quarterly Tax Reporting

Minimum Wage Compliance

New State Registrations