Payroll and HR Solutions for Construction Businesses

Build stronger crews and more profitable projects with PeopleWorX. Our people-centric platform simplifies payroll, HR, and compliance, while giving you the tools to track labor, manage safety, and adapt as your construction business grows.

Payroll Solutions for Construction Business

We understand that construction payroll and HR management are unlike any other industry. Between prevailing wage laws, certified payroll reporting, job costing, and managing a mobile workforce across multiple job sites, the administrative burden on construction companies is significant.

At PeopleWorX, we specialize in helping construction businesses navigate these unique challenges with confidence. Our solutions are designed to simplify compliance, streamline payroll processes, and support your project managers, back-office staff, and field employees with technology that works where they work. From automated time tracking and labor allocation to onboarding, benefits administration, and safety training, we deliver strategic, measurable solutions that help you stay on schedule and on budget, without losing sight of your people.

Schedule a Free HR & Payroll Consultation

Construction Payroll, Timekeeping and Compliance Made Simple

Weekly payroll and certified payroll reporting are essential for construction businesses. PeopleWorX makes the process easier by integrating directly with Certified Payroll systems, including LCP Tracker and state-specific platforms like Maryland’s. We support wage classifications, project location tracking, daily hours, and prevailing wage documentation to help you stay audit-ready and compliant.

Support with I-9, E-Verify and Work Eligibility Audits

Verifying employee work eligibility is critical in construction. PeopleWorX helps you avoid costly compliance issues by guiding your team through proper I-9 and E-Verify procedures. We also help clarify the difference between Social Security Numbers and ITINs, so you can ensure accurate records and meet federal and state requirements.

Job Costing Integration with Your Accounting System

Certified Payroll

Piece Rate Pay

Custom Data Exports

Enhanced Labor Allocation

Enhanced Timekeeping Tracking

Certified Payroll

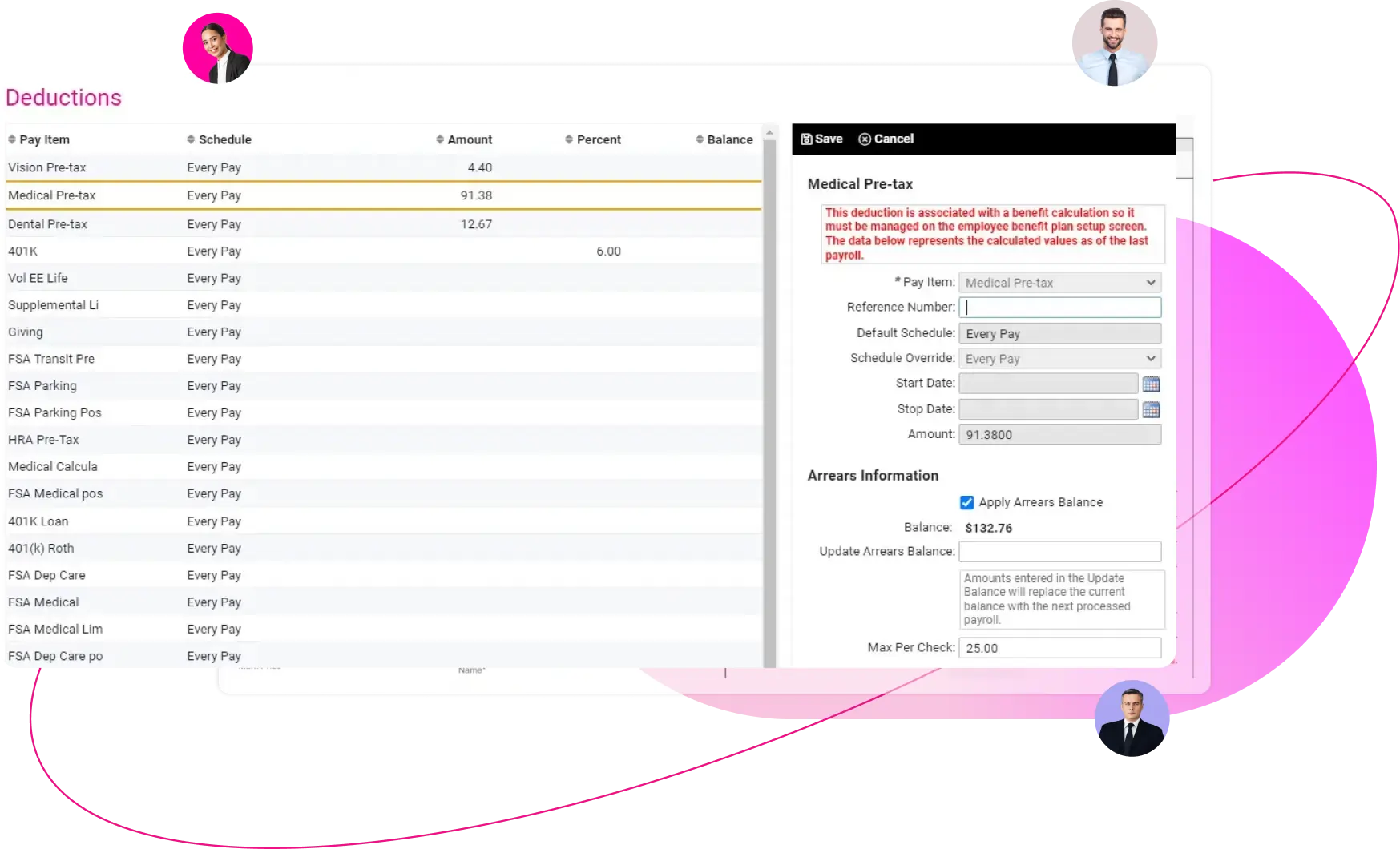

Manage Union Deductions and Union Benefits Easily

We understand the challenges construction payroll faces in administering Union Deductions and Union benefits. deductions and benefits have a wide variety of calculation methods ranging from per hour calculations to a flat dollar amount. Union deductions and benefits also require to be paid almost immediately to the Union Administrator. It is important to have these items implemented correctly with each new employee and have a streamline method to pay these amounts.

PeopleWorX can set these deductions and benefits up for you with an automated payment method.

See how clients are future-proofing their HR management.

I have been using this payroll service for over a year. I am very pleased with the ease of use. My customer service rep Jessica is the best. She gets back to me promptly and takes care of any need I may have. They truly make payroll easy. Highly recommend!

Retail

HR Manager

Our dedicated payroll specialist does a wonderful job communicating. They are great whenever there is an issue.

Construction

Office Manager

As an HR Manager in retail, reliable payroll is critical, and PeopleWorX has delivered exactly that. The payroll platform is straightforward and efficient, which saves me valuable time each pay period. I also appreciate the consistent support. Our rep is always responsive and makes sure questions are handled quickly. Having a payroll partner I can count on has made a noticeable difference, and I’m very happy with the service.

Retail

HR Manager

I’ve been with PeopleWorX for 6 months now and they do not disappoint! My specialist is so helpful and quick. He makes my life easier every time payroll comes around.

Healthcare

HR Director

Religious / Nonprofit

Office manager

Effective Employee Handbook creation to help with policies and cut unemployment costs

We understand that construction businesses, like any business, need to have company policies in place to keep your employees and work environment safe and to safeguard you from legal complications.

With a solid employee handbook in place, construction companies can cut down on unemployment costs. The company should document all employee-related events. When an employee is terminated, the company can present a well-documented case with the necessary reason for terminating the employee.

Like the manufacturing business, construction will also have OSHA requirements. PeopleWorX can help you comply with OSHA procedures, creating or updating employee handbooks and company policies if you require them.

Uncover Hidden HR Risk

An Employee Handbook is an essential HR tool to combat risk. Do you know how protected your business is from HR issues?

Take Your HR Risk Assessment →Eliminate large down payment for your workers’ compensation insurance and minimize year-end adjustment with Pay As You Go Workers Comp?

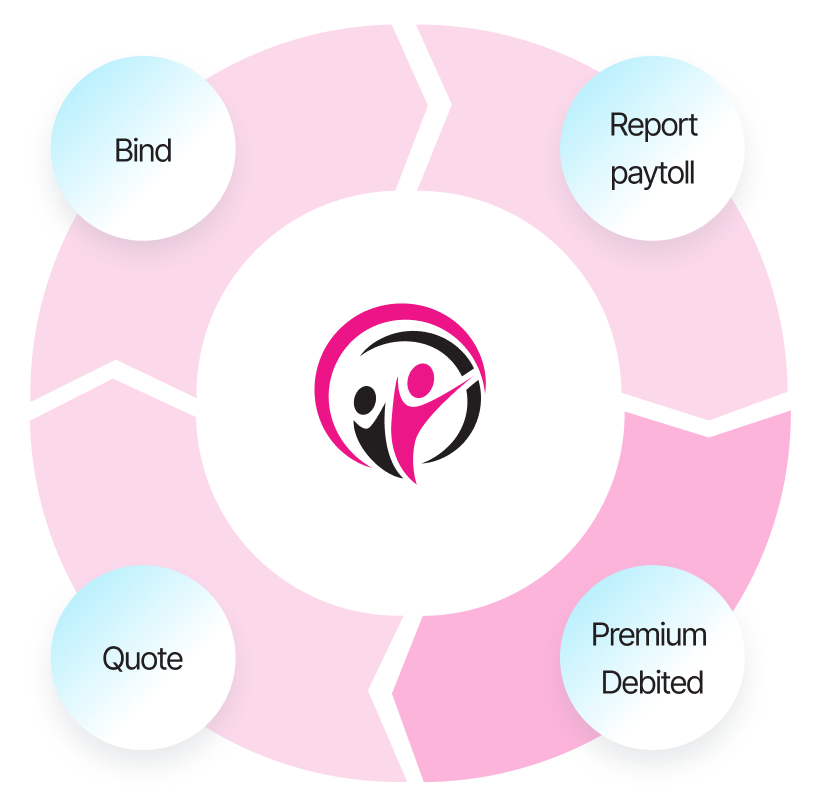

As a nature of the industry, construction payroll may experience a spike in labor, which in turn adds up on the workers’ comp. With Pay-As-You-Go, you can eliminate the down payment and pay for the premium only when the payroll is run.

PeopleWorX can help you with Pay-As-You-Go Workers’ Comp and help you manage better cashflow for your business.

Pay as you go

- Improve Cash Flow

- Reduce Audit Exposure

- Monthly Reporting

- Zero Down payment

- Minimize Surprise Bills

- Pay on Your Current Payroll

Complete Tax Compliance

Our experienced team partners with construction businesses to ensure compliance with labor laws, safety regulations, and workforce requirements. We stay current with industry updates and proactively keep you informed, so you can stay focused on the job site while we help you manage risk and stay compliant.

W-2 / 1099 Filing

ACA Compliance

Quarterly Tax Reporting

Minimum Wage Compliance

New State Registrations